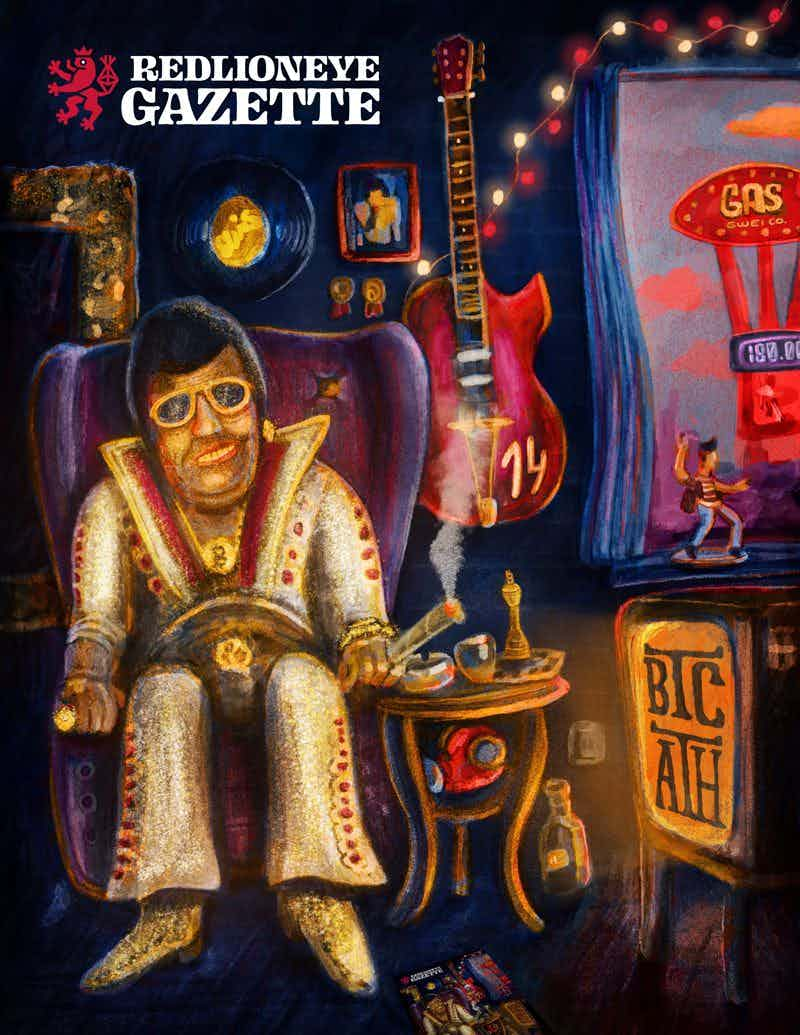

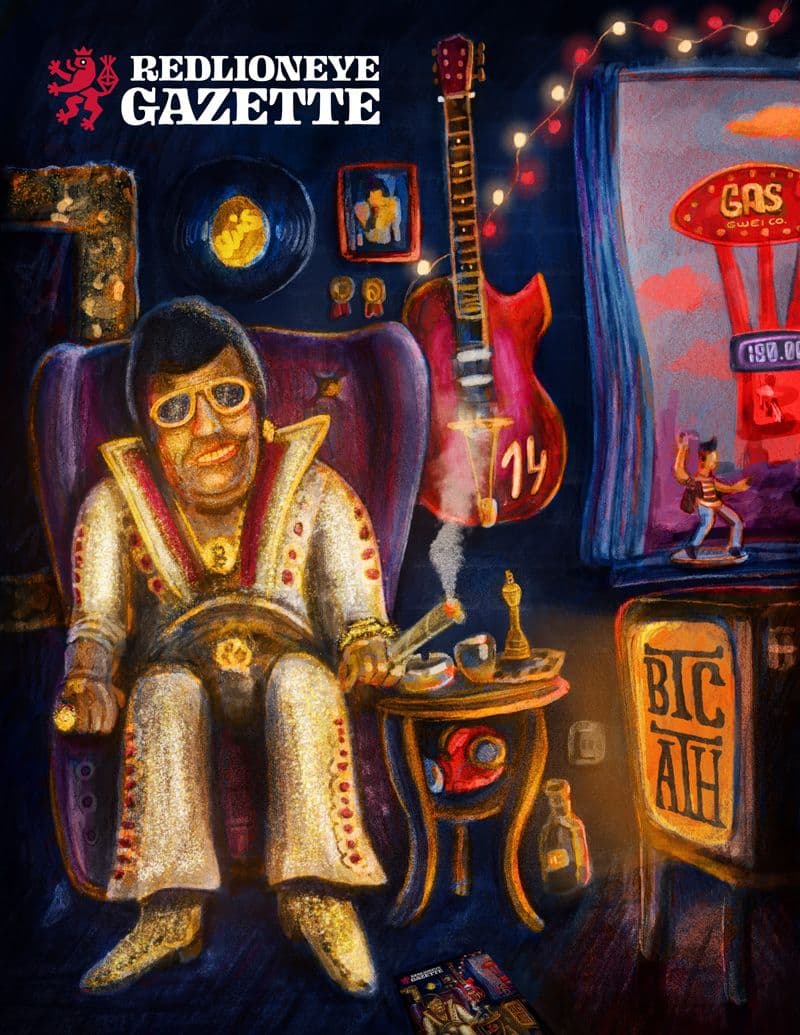

#14

Merry Xmass King Elvis!

The very rare Xmass issue (14 pcs.) works again with the ''The King'' concept as the price has been surging that period. An obvious nod to BTC being The King of crypto.

Dudly

Issues

#14 Merry Xmass King Elvis!

Week 51 2020 | Dec 20 2020

The very rare Xmass issue (14 pcs.) works again with the ''The King'' concept as the price has been surging that period. An obvious nod to BTC being The King of crypto.

Traits

Style:

Illustration

Illustration

Colors:

Full

Full

Theme:

King

King

Issue Number:

Encrypted

Encrypted

Music:

No

No

SoundFX:

No

No

BTC Sign:

Yes

Yes

Artists

Dudly

ArtDrop

BANANAKIN

BANANAKIN

#14