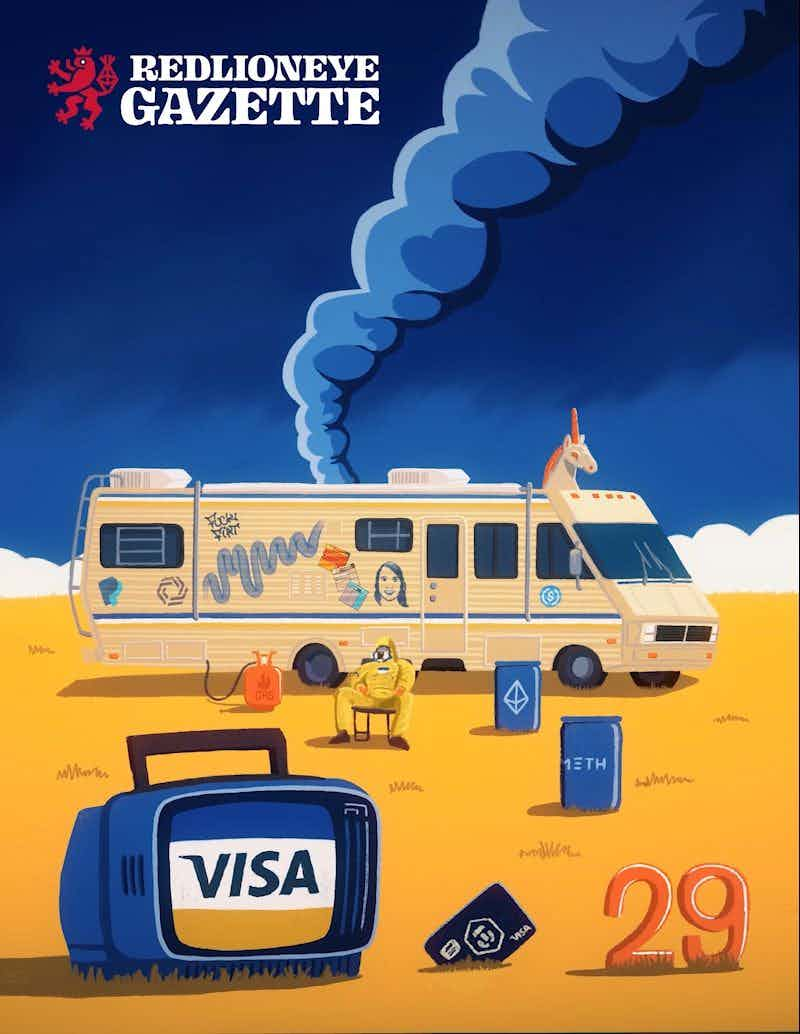

#29

VISA Breaking Bad

Visa had just allowed payments in cryptocurrency.

Dudly

Issues

#29 VISA Breaking Bad

Week 13 2021 | Apr 04 2021

Visa had just allowed payments in cryptocurrency.

Traits

Style:

Illustration

Illustration

Colors:

Limited

Limited

Theme:

TV Series

TV Series

Issue Number:

Encrypted

Encrypted

Music:

No

No

SoundFX:

No

No

ETH Sign:

Yes

Yes

Artists

Dudly

ArtDrop

greek freak

greek freak

#29