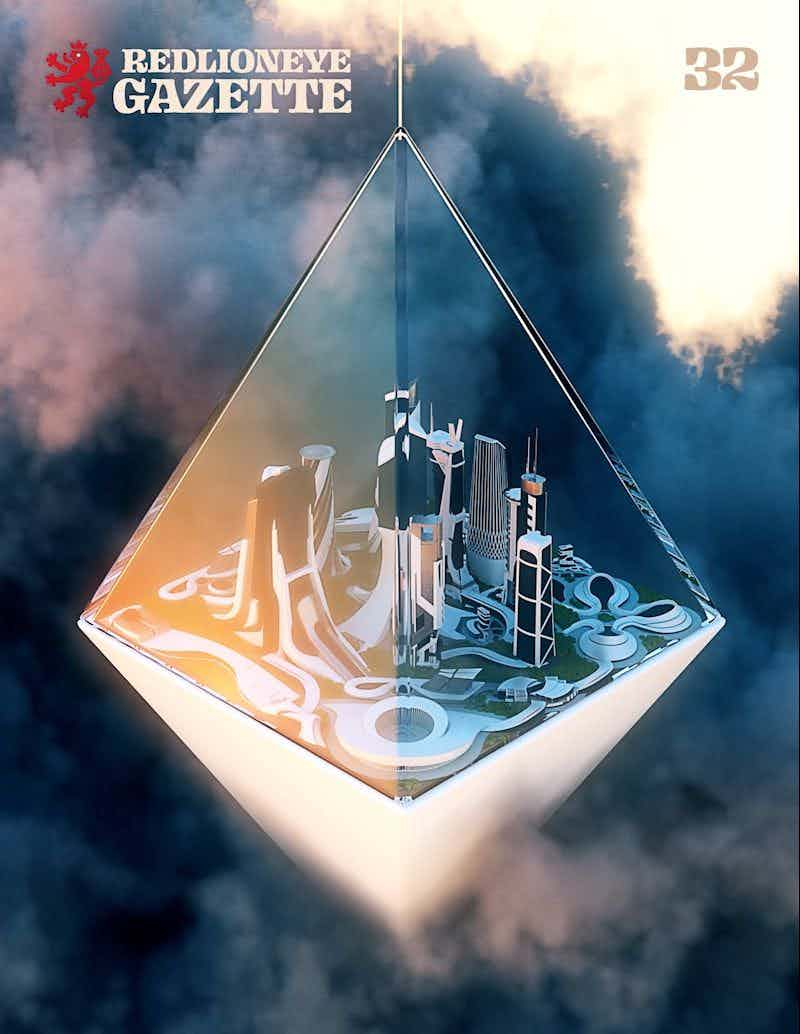

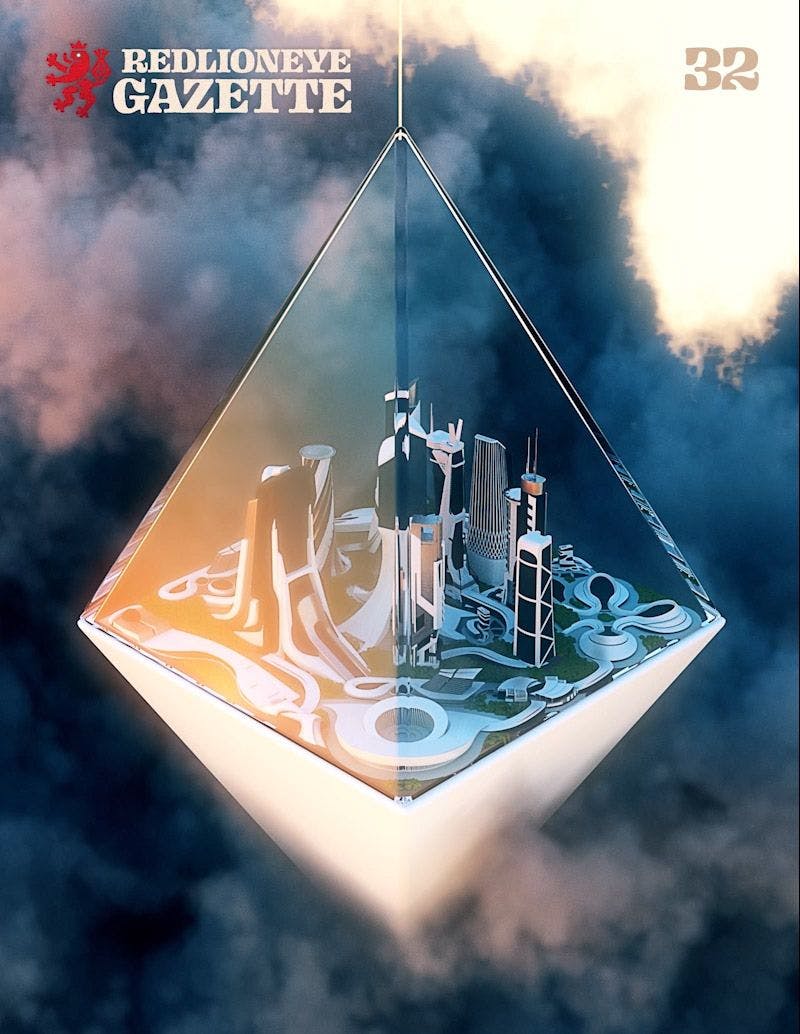

#32

Welcome to Ethopia

Ethereum breaking its ATH and crossing $2,600 was the highlight of the week. One that many were earnestly anticipating for months over.

Dudly

Issues

#32 Welcome to Ethopia

Week 16 2021 | Apr 25 2021

Ethereum breaking its ATH and crossing $2,600 was the highlight of the week. One that many were earnestly anticipating for months over.

Traits

Style:

3D Art

3D Art

Colors:

Full

Full

Issue Number:

Regular

Regular

Music:

Yes

Yes

SoundFX:

No

No

ETH Sign:

Yes

Yes

Artists

Dudly

ArtDrop

sabet

sabet

#32