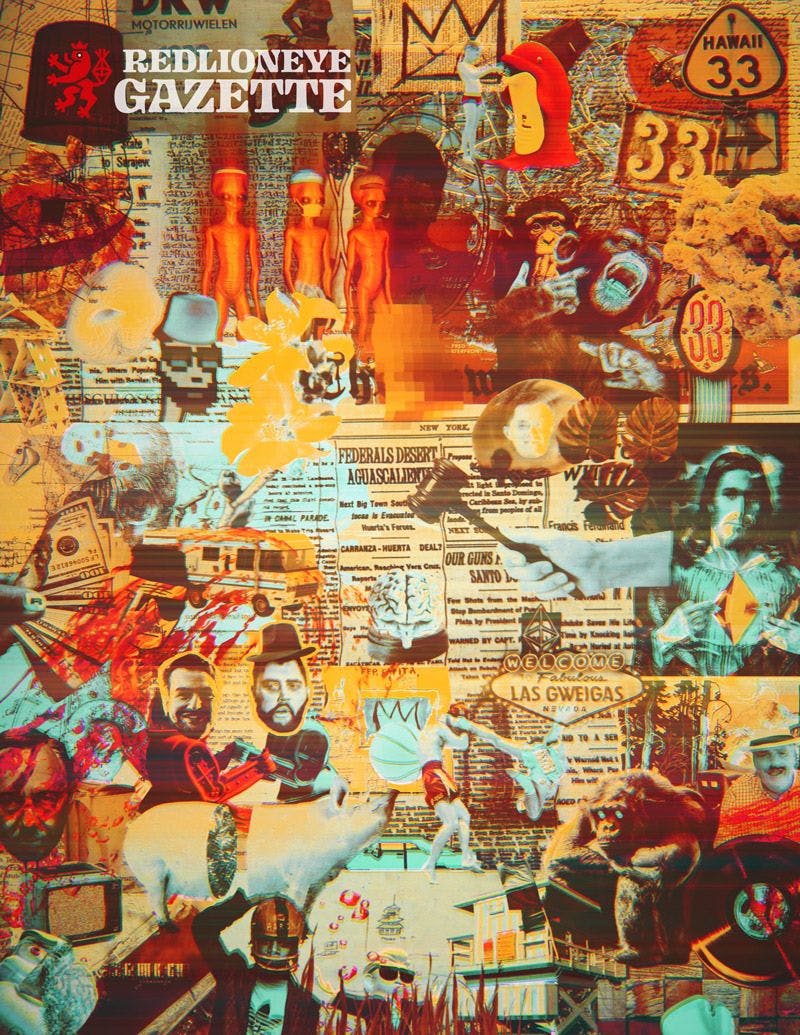

#33

Crypto Twitter (Boxing) Bickering!

The most fun news was about Crypto-Twitter influencers going head to head with boxer Andre Cronje. The match was offered for betting by Pokershares.

Dudly

Issues

#33 Crypto Twitter (Boxing) Bickering!

Week 17 2021 | May 02 2021

The most fun news was about Crypto-Twitter influencers going head to head with boxer Andre Cronje. The match was offered for betting by Pokershares.

Traits

Style:

Collage

Collage

Colors:

Full

Full

Issue Number:

Encrypted

Encrypted

Music:

No

No

SoundFX:

No

No

ETH Sign:

Yes

Yes

Artists

Dudly

ArtDrop

ROBNΞSS \/IRTUAL

ROBNΞSS \/IRTUAL

#33