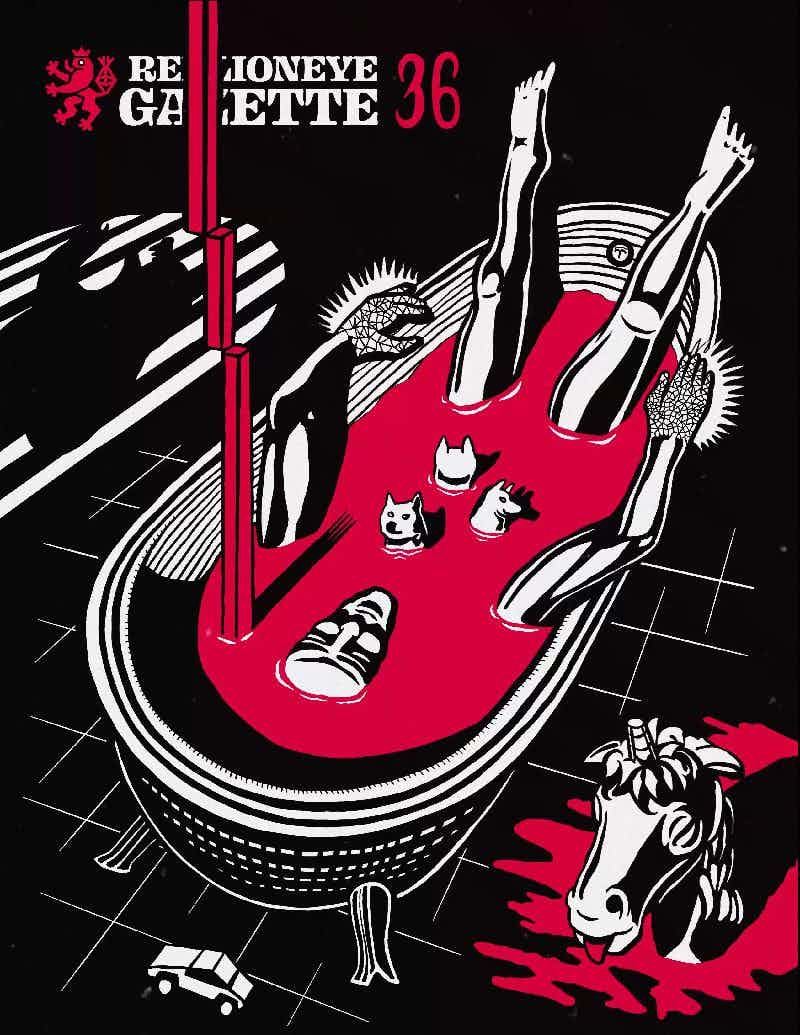

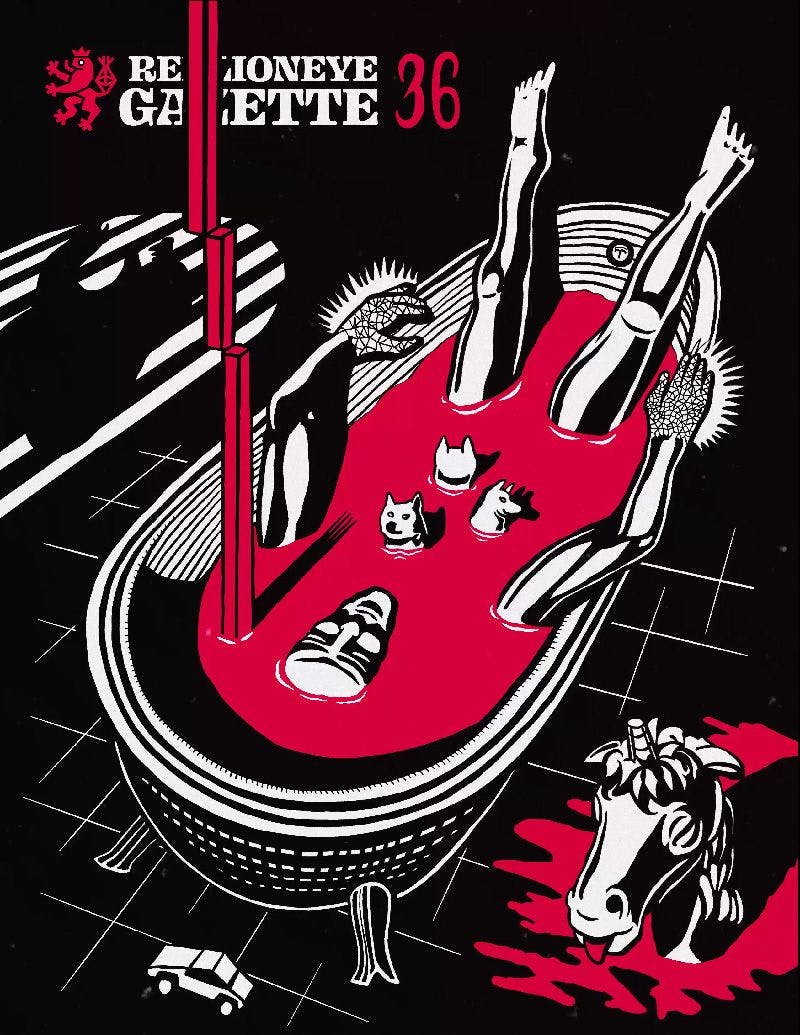

#36

Crypto Bloodbath AKA BTFD!

“After the rain, the sun will reappear”, or vice versa in this case. BTC dropped under $30k, this being a multi-month low.

Dudly

Issues

#36 Crypto Bloodbath AKA BTFD!

Week 20 2021 | May 23 2021

“After the rain, the sun will reappear”, or vice versa in this case. BTC dropped under $30k, this being a multi-month low.

Traits

Style:

Illustration

Illustration

Colors:

Redlion

Redlion

Issue Number:

Stylized

Stylized

Music:

Yes

Yes

SoundFX:

No

No

Artists

Dudly

ArtDrop

Dexamol

Dexamol

#36