#41

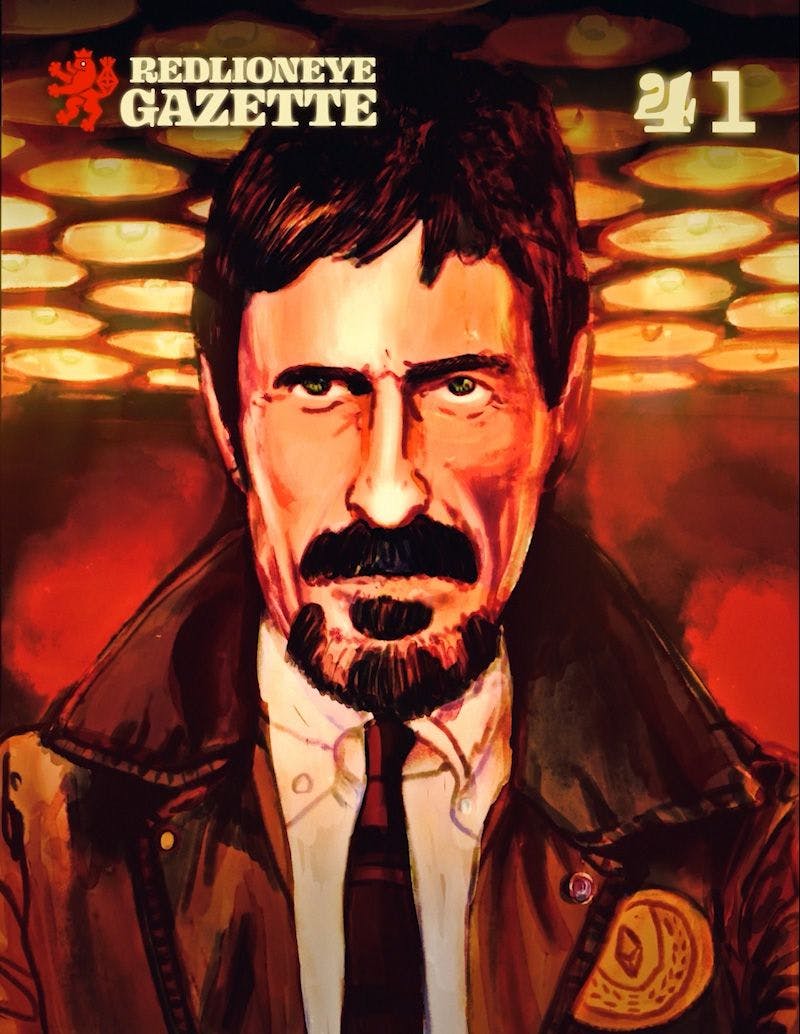

McAfee The Variant

During this week Tech entrepreneur and Crypto enthusiast John McAfee was found dead in his jail cell. The cause of death was apparently a suicide…

Dudly

Issues

#41 McAfee The Variant

Week 25 2021 | Jun 27 2021

During this week Tech entrepreneur and Crypto enthusiast John McAfee was found dead in his jail cell. The cause of death was apparently a suicide…

Traits

Style:

Painting

Painting

Colors:

Limited

Limited

Theme:

TV Series

TV Series

Issue Number:

Animated

Animated

Music:

Yes

Yes

SoundFX:

No

No

ETH Sign:

Yes

Yes

Artists

Dudly

ArtDrop

Lucky Maneki

Lucky Maneki

#41