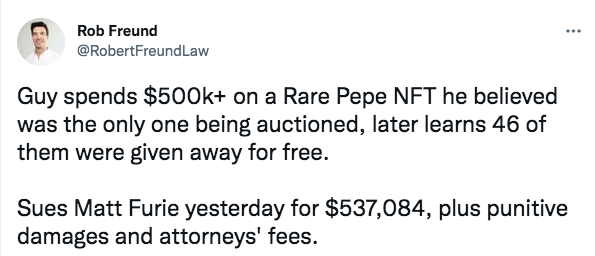

The road towards NFT glory is littered with costly pitfalls. From accidentally listing high value NFTs for a fraction of their price to failing to delist properly and having your NFTs stolen, there’s always potential for disaster. One person more painfully aware of this than anyone else is Halston Thayer, a collector who paid over $500k for what he thought was a 1/1 Rare Pepe, only for another 46 to be immediately given away for free. Unsurprisingly, Thayer is now taking his grievance to court.

Cultural and internet history

Rare Pepes are some of the most important pieces of internet history. Their sales even predate NFTs. A set appeared on eBay back in 2015 and its price climbed up to $99,166 before it was delisted. Attempts to catalogue and exchange Rare Pepes led to the creation of one of the first crypto marketplaces in 2016, enshrining them as important cultural and historical objects. Sales routinely reach mind boggling levels. The super rare Homer Pepe recently sold for 205 ETH so it’s not surprising that somebody would spend $500k+ on a one of a kind piece.

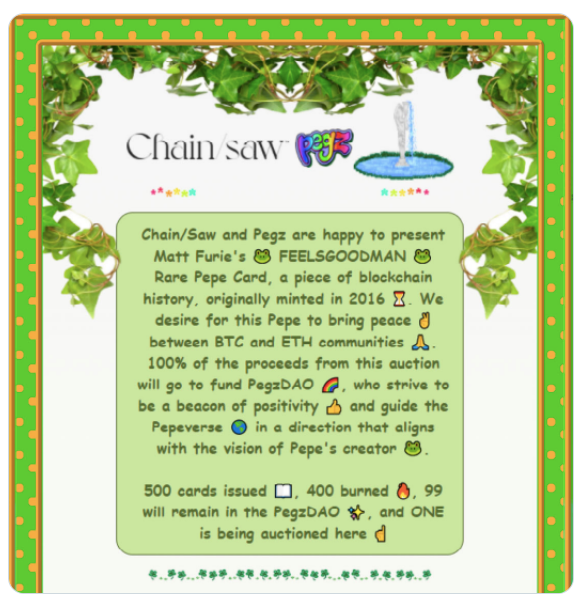

This sorry tale begins in October when Chain/Saw LLC and PegzDAO set up an auction for a Rare Pepe. Although 500 editions of the Pepe existed, the advertisement for the auction claimed that 400 would be burned and the other 99 stored in PegzDAO’s vaults. Only one would be auctioned. From this, it seems reasonable to infer that only the single, auctioned Pepe would be in circulation.

Chain/Saw and PegzDAO remained true to their word about only auctioning off one Pepe, but they neglected to mention that another 46 would be given away for free almost immediately afterwards. The release of the free Pepes obliterated the price of Thayer’s NFT, writing off nearly $500k and tanking it to just $30,000. He tried to send his Pepe back for a refund but the request was denied, paving the way to an explosive court case that will take a deep dive into the still fairly unregulated NFT market.

A case of misrepresentation - or misunderstanding?

The crux of the lawsuit alleges that Chain/Saw and PegzDAO (named as co-defendants) lied about how many Pepes would be circulated to inflate the auction price. A screengrab of the terms appears to suggest that this was the case, or at the very least shows where the confusion might lie. It certainly doesn’t mention anything about giving other Pepes away for free. The announcement makes lots of sweeping statements about peace and positivity, but at least one person has been left feeling anything but.

Thayer’s lawsuit argues that by agreeing to the sale he entered into a legally binding contract that only one of the Pepes would ever be circulated. The phrase “unique asset” occurs 7 times in the document, a label that is branded “blatantly false.” The number of free Pepes in circulation, it alleges, means that Thayer’s NFT is “anything but rare or unique.”

The lawsuits chances of success are up for debate

The document also accuses Chain/Saw and PegzDao of deliberately misrepresenting how the 99 Pepes would be held and engaging in “unlawful, unfair and/or fraudulent acts and practices.” It’s strong wording for an NFT that started life as a meme. The lawsuit also seeks to stop the defendants releasing any more Pepes from the PegzDao vault and devaluing Thayer’s collectible still further.

Pepe's long and troubled history

PegzDAO is a DAO founded by Pepe creator Matt Furie. Chain/Saw is a curated NFT marketplace that’s still in its early days. This isn’t the first Pepe controversy that Furie’s been embroiled in. When the cartoon became associated with far right and Neo Nazi ideology (it was flagged as hate speech by the Anti-Defamation League), he embarked on a lengthy campaign to salvage its reputation.

His legal team was also behind the copyright battle over Sad Frogs, a collection of 7000 generated frogs bearing more than a passing similarity to Pepe. The project was delisted from OpenSea in August despite a $4 million trading volume, igniting yet another debate about derivative projects in the NFT space. For a meme so apparently benign, Pepe certainly has a tumultuous history.

This lawsuit will likely hinge on nuances including the nature of the auction’s terms. For example, while the post states that the other 99 Pepes will remain with the DAO and only one will be auctioned, it doesn’t make any guarantees that those NFTs won’t be given away for free at a later date. Regardless of the outcome, it’s always intriguing to see digital ownership tested in court. With the U.S. government already taking an interest in crypto, every case means further scrutiny and, potentially, more regulation.