Bloomberg News got an anonymous tip today that has massive implications for the NFT and crypto space. Apparently, the United States' Security and Exchange Commission is investigating whether or not Yuga Labs, creator of the Bored Ape Yacht Club NFT collection, violated US law when they created the BAYC. Additionally, the investigation is covering whether or not the distribution of ApeCoin from earlier this year was a similar violation.

The legal issue in question is whether or not the aforementioned NFTs and tokens represent securities. Essentially, a security, like a stock, has stricter regulations than a simple asset (like property, commodities etc.). It seems clear that SEC Chair, Gary Gensler, is hoping to classify all cryptocurrencies, except for Bitcoin, as securities. This will empower his agency to regulate the space thereby forcing a much more restrictive set of guidelines on the entire industry. However, there is some hope that his efforts will lead to a spectacular defeat in court.

I just spoke to arguably the leading Securities lawyer in the country

— EllioTrades (@elliotrades) October 11, 2022

The Yuga headline appears to be a MASSIVE nothing burger

They are incredibly well insulated against securities laws

Otherside twitter hack is a clear psyop to spook you

Today is a case study in manipulation

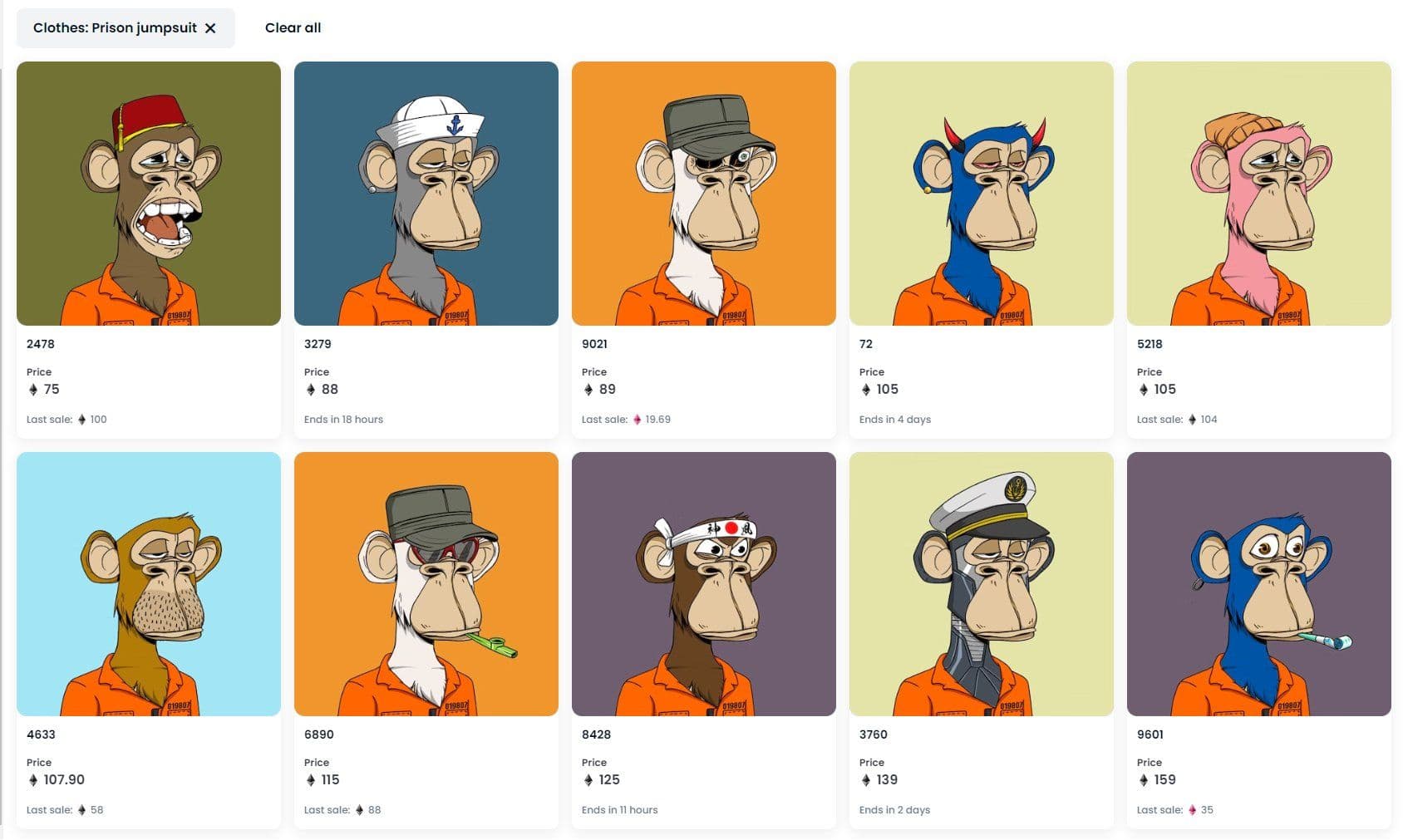

So far, the investigation is in its initial phases and Yuga Labs has not been accused of a crime. Many in Crypto Twitter were quick to point out that Yuga has a solid legal case and that this whole situation is merely FUD. Others deployed hilarious memes to assuage their frayed nerves--after all, this is merely the latest of many recent regulatory encroachments on Crypto.

When you KYC’ed your wallet and now the SEC is investigating YUGA LABS: pic.twitter.com/4hyTMvlPkj

— MinisterOfNFTs 🔮 (@MinisterOfNFTs) October 11, 2022

NFT hodlers, keep your eyes open: Only time will tell how this latest SEC plot plays out.