Bitcoin price rallied towards the USD 18,500 level, where sellers took a strong stand. As a result, there was a sharp bearish reaction and BTC declined below USD 18,000.

The price even broke the USD 17,650 support, but the bulls protected BTC from more losses, and currently it is trading above USD 18,000 again.

The last time BTC was above the USD 18,000 level is December 2017.

12 years ago back in July 2010, a single BTC was swapping for $0.08 per unit. This means with BTC above the $18k handle (or just below), the crypto asset has increased in value over 22 million percent since 2010. If a person waited even five years later, in 2015 the price of BTC was swapping between $200-300 per coin. An investment in bitcoin at this level (2015) would give an investor 7,100% with BTC exchange rates at the $18k mark.

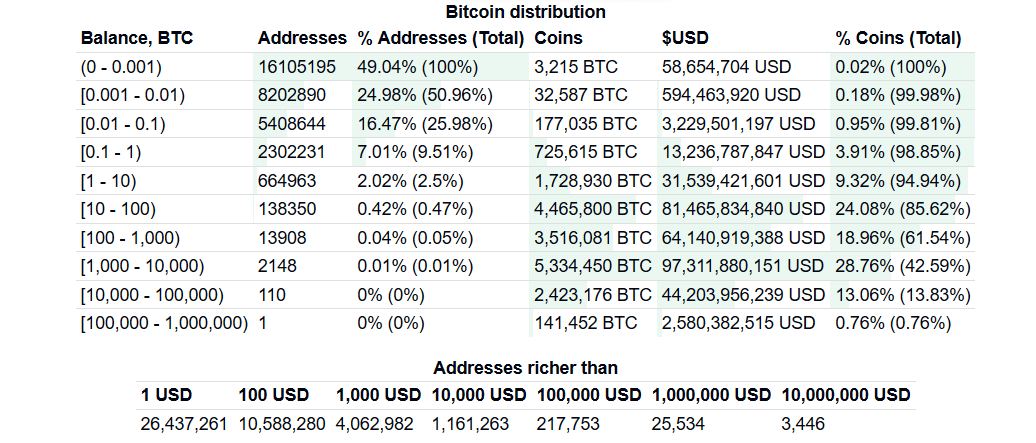

Data shows that at the current price levels, any person with a touch over 55 BTC has crossed the millionaire zone. Statistics show that there are 664,900 unique addresses with anywhere between 1-10BTC and 2.3 million unique addresses with 0.1 to 1 BTC each. Stats from bitinfocharts.com also indicates there are 25,810 unique addresses that own a million dollars worth of bitcoin. Beyond those million-dollar whales, 3,442 addresses contain $10 million in BTC today as well.

Sweet reminder: Bitcoin is currently the 16th largest asset by market cap in the world.

— David Puell (@kenoshaking) November 18, 2020

Source: https://t.co/E2emxTlCcr pic.twitter.com/5WRn3ugqpH

With BTC prices riding so high, this week crypto proponents have been wondering whether or not an ‘altcoin season’ is coming around the bend. So far, with BTC’s dominance levels at 68.7%, it doesn’t seem to be the case, at least for now.

There is a clear difference between the ongoing uptrend and the 2017 rally. This time, Bitcoin has shown more composure and stability throughout the uptrend, consecutively reclaiming major resistance levels.

But there is always a case for the opposite as well.

I don't mean to be a party pooper but a reason for the BTC rally is that Chinese miners had their usual OTC liquidation venues closed down by the CCP. Expect that sell pressure to return eventually with a vengeance.

— Lasse Clausen (@lalleclausen) November 18, 2020