With crypto winter predicted by many to be right around the corner, we may be entering into one of the greatest opportunities to buy crypto tokens and NFTs. With that in mind, collectors and investors should have a plan for how to build up their personal collections or investable assets at rock-bottom prices, which we’ve already begun seeing across the space. Cryptocurrencies and NFTs are still within the realm of highly speculative alternative investments, but that doesn’t mean that general investment principles—like the need to diversify—don’t apply. Below you’ll find a list of various categories within the NFT and digital asset ecosystem that you may or may not already be involved with, but can consider when the market turns red(der than it already is).

- Early NFT Projects

A few projects immediately come to mind when we think of the first-movers in this space, including CryptoPunks and Ether Rocks, both now nearly unattainable for the vast majority of collectors and investors. But as we’ve seen elsewhere in this week’s issue of the Gazette, there are a number of early projects that have incredible appeal as pure collectibles, but enough volume and historical price appreciation that they can serve as investable assets for some.

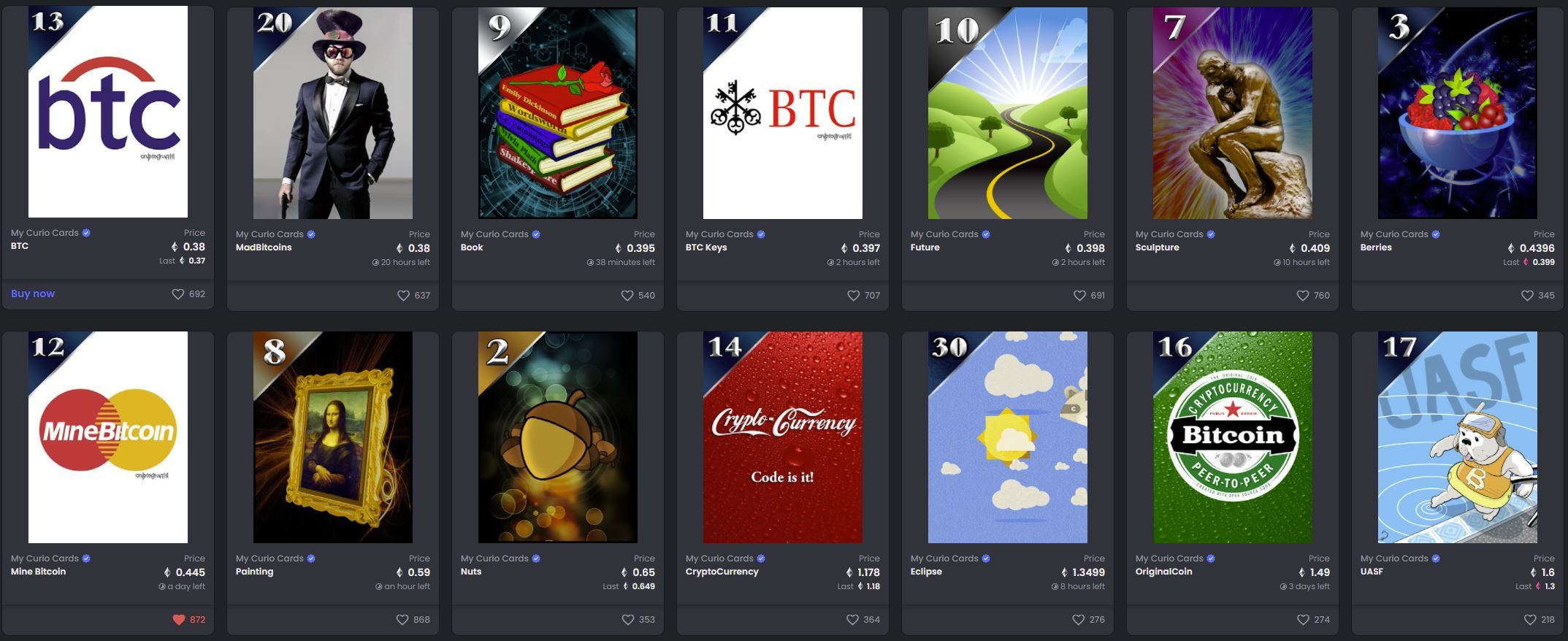

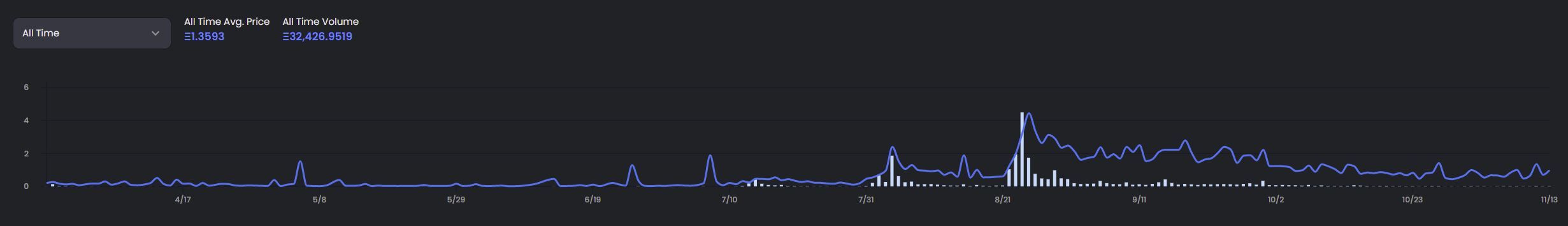

One such project is CurioCards, described as follows: “Curio Cards is an online art show and permanent gallery that launched on May 9, 2017. Curio is the first Art NFT project on Ethereum, featuring 30 unique series of cards from 7 different artists. Curio Cards are referenced with CryptoPunks and CryptoKitties in the original ERC-721 Non-Fungible Token Standard, and pre-dates them both.”

CurioCards have enjoyed mass appeal and have ridden the wave of market highs and lows. As one of the original tokens minted on the Ethereum blockchain, they represent an affordable and “collectible” way to get exposure to historical projects.

- Gaming and Metaverse NFTs

Follow the smart money, they say, and a lot of it is being poured into gaming and metaverses these days. The video game industry is the largest and most profitable entertainment industry, and it’s not even close. The multi-trillion-dollar business started shaking up the NFT and digital asset industry in the last couple of years, with huge games like Axie Infinity, which had $364 million in revenue in August 2021 and recently raised another $150 million in funding, led by VC firm Andreessen Horowitz. Another major game that attracted much attention this year is ZED RUN. The game implements breeding and gambling features and calls itself “a provably fair digital horse racing game built on blockchain technology.” The markets for both have recently taken a hit and may continue losing value, priming them for those looking for a good entry point.

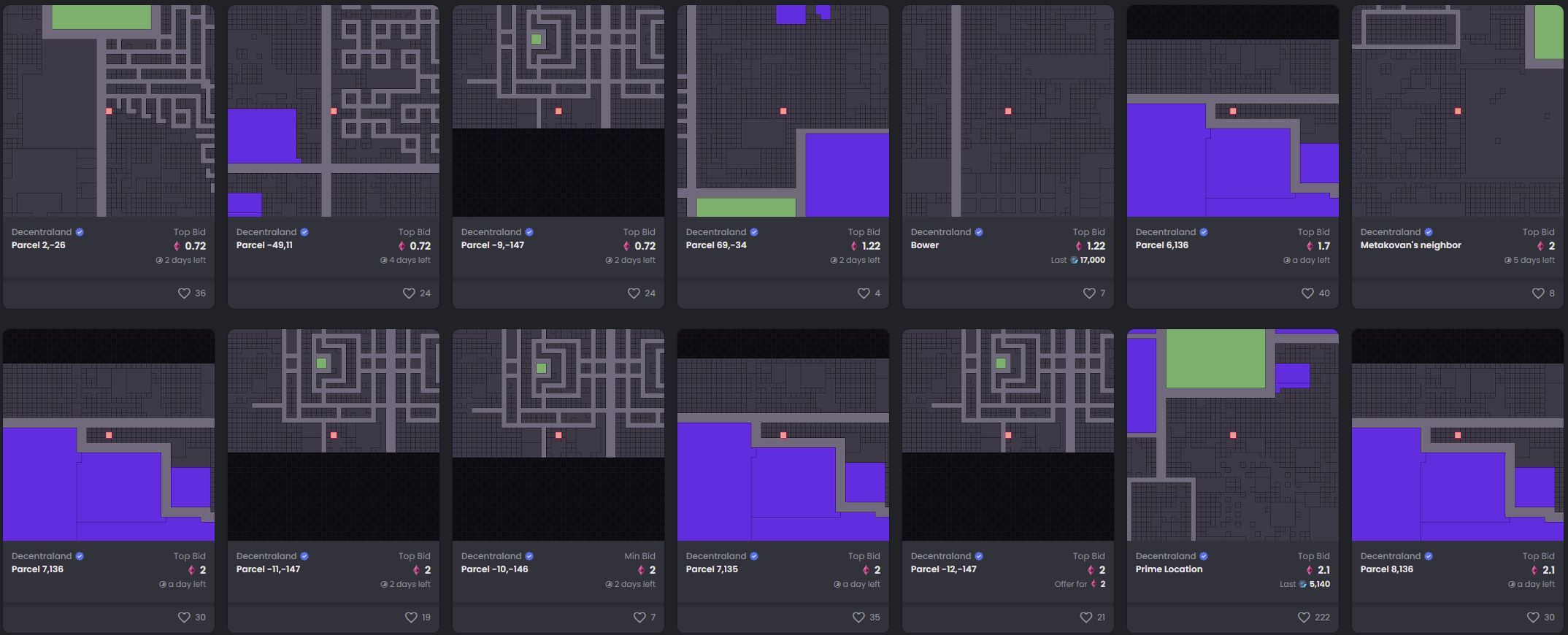

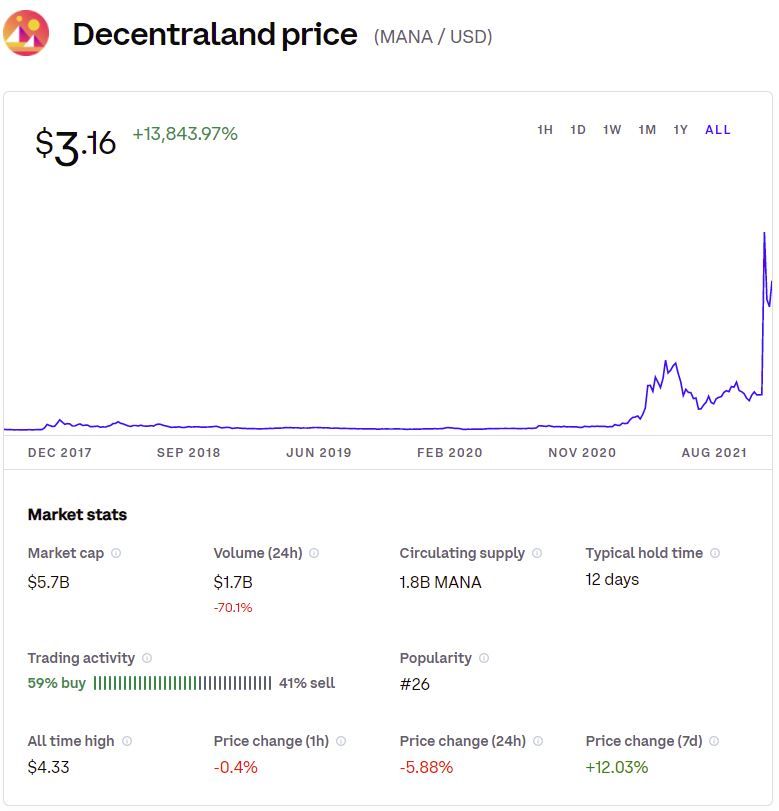

Facebook recently announced that it is changing its parent name to “Meta,” which signals a pivot in its corporate strategy. The company will begin focusing on the metaverse as a development of online social interactions. That project is still months or years out, but there are existing players in the space, including Decentraland and The Sandbox, which have been around for many years and have relatively recently integrated cryptocurrencies and NFTs to better monetize the experiences they offer. Both universes allow users to purchase plots of land that can be customized by individual owners in many ways. Both also offer tokens that are used as world currencies as well as games and opportunities for interacting with others through avatars. Decentraland, in particular, saw a huge spike in trading volume of parcels and assets following Facebook’s announcement, with a similar move in its token, Mana.

- DAO Tokens

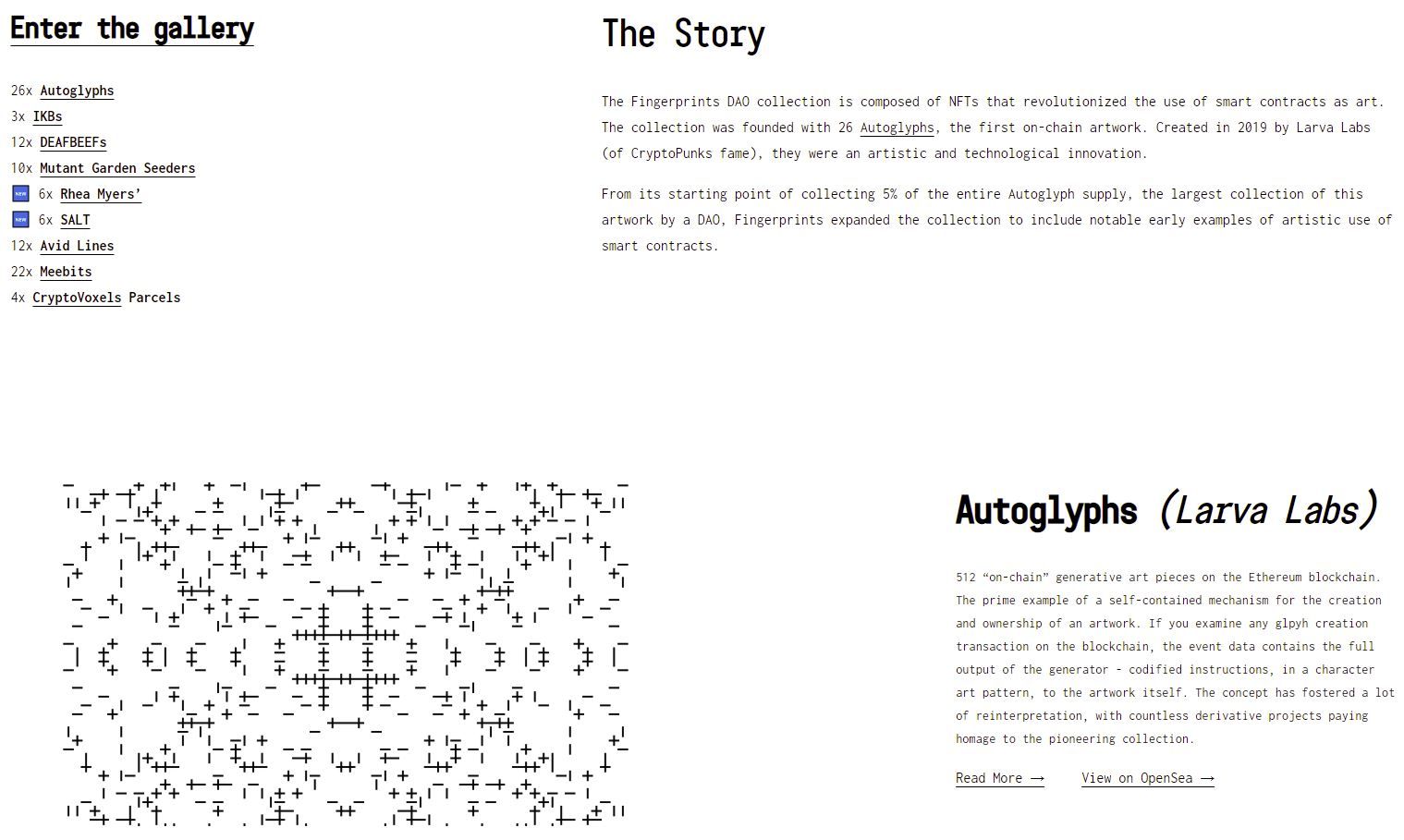

Our final category for this week, and clearly the least known, is DAO tokens. DAOs, or decentralized autonomous organizations, offer members a collective experience in line with that organization’s broad mission. For some DAOs, such as Fingerprints, that involves acquiring valuable and historic works of NFT art like Autoglyphs. For others, like the recently-formed ConstitutionDAO, it revolves around a singular point of focus, like acquiring a copy of the U.S. Constitution at auction, or creating a community of members that can offer unique services or insights to one another, such as Friends with Benefits (often referred to as just FWB). To be clear, most DAO tokens can be acquired through decentralized exchanges or through swaps, even without formally becoming a member.

The way most DAOs monetize membership is by circulating governance and utility tokens that give owners a say in how the organization is run. Although the tokens do not represent fractionalized stores of value (which would make them securities under the laws of many jurisdictions), generally, the better the DAO performs its mission, the greater the DAO token appreciates. This represents a neat workaround that regulators haven’t keyed in on yet (and maybe never will given the disconnect between value and ownership), but collectors and investors can take advantage of this by gaining exposure to organizations that are heavily invested in assets that they might not be able to acquire on their own.

***

Next week we’ll take a look at three more ways to diversity your portfolio of digital assets, including the much-maligned PFPs (profile pictures) and NFT art.