In fact predictions of much more bullish price action to come are pretty easy to come by these days. Ethereum has blasted off!

After running up in price basically non-stop for weeks on end, the second largest cryptocurrency by market cap recently peaked above $4,300 and approximately half a trillion in overall market capitalization, which is just a little less than half of the BTC market cap!

Ethereum just can’t be denied! The price of ETH has risen so fast over the past few weeks that markets across the entire DAPP blockchain are experiencing a wild ride to say the least! It’s great seeing ETH have so much success, achieving greater adoption and usage by newcomers, but gas fees continue to present a bigger and bigger problem to all users as the price of ETH rises so dramatically.

#Bitcoin Market Dominance Falls to Lowest Level Since Mid-2018

— Decrypt (@decryptmedia) May 16, 2021

► https://t.co/Hrgrohmm9M pic.twitter.com/vEgJ5mpCum

Ethereum fans probably aren’t the only ones to take note of recent activity...

The Ethereum ecosystem continues to gain new participants and investors at an unprecedented rate. Layer two scaling solutions have recently seen an uptick in activity, no doubt due to users eager to participate in their respective decentralized economy without incurring such steep fees every step of the way.

How badly do we need Etheruem L2s?

— Hayden Adams 🦄 (@haydenzadams) May 12, 2021

Today @Uniswap users ALONE spent ~$42m on Ethereum gas fees.

This is almost 5x what was spent on Bitcoin network fees during the same period https://t.co/8nL6P8gRkq

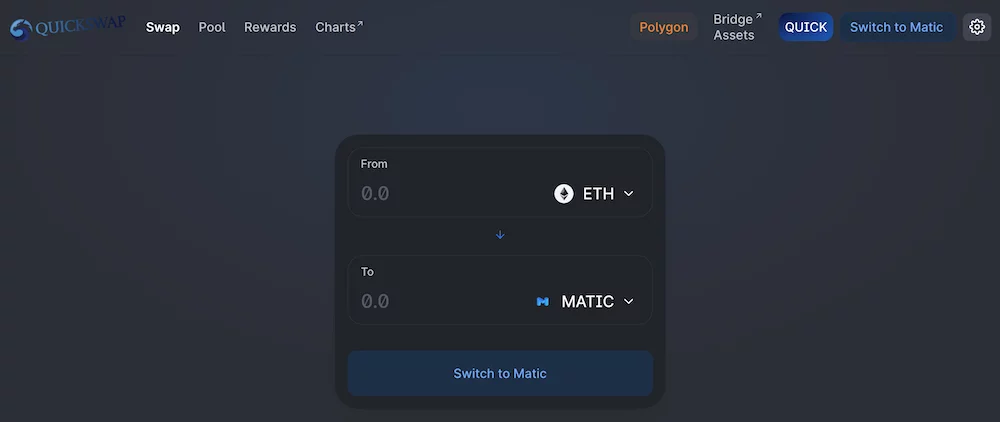

The Ethereum layer 2 networks like Polygon have recently surged with users eager to escape Ethereum mainnet gas fees. Much of the recent MATIC traffic is being generated by Quickswap activity. A MATIC network alternative to Uniswap found on Ethereum’s layer 1.

Solutions like this are poised to become much more important in the near future for frequent blockchain interaction. Without these layer 2 networks Ethereum fees could quickly amount to prohibitive expenses which even believers in the ecosystem might find intolerable. Of course eventually one might wonder, just how essential will layer 2 scaling solutions like Polygon be once Ethereum scales natively as a Proof Of Stake blockchain in ETH 2.0? I’m not suggesting there will be no use case, in fact there might still be much reason to be excited about many layer 2 networks and what they can offer.

Gas-fees on #Ethereum L1 are high

— Loopring (@loopringorg) May 15, 2021

but you have a choice 🧐

Pay them on every swap, or...

pay them only once to fund your L2 account

+ swap gas-free forever onward ✨

with the same Security as L1 💙

Connect any wallet➡️ https://t.co/qRy7TPhGHD pic.twitter.com/o5xBV3xQQQ

Loopring is another L2 solution aimed at drastically reducing user gas fees by transacting on 2nd layer chain instead of directly on the Ethereum mainnet.

If the price of ETH continues to rise, which many believe it easily can and will, then just what will the near-term landscape look like for Ethereum participants? Will layer 2 solutions like Polygon and Loopring become all but required in order to effectively transact on the blockchain without quickly enduring unaffordable network fees. These fees are tough to absorb even before giving ETH serious consideration as a long term store of value asset with a deflationary supply.

$ETH balance on exchanges continues to drop.

— IntoTheBlock (@intotheblock) May 11, 2021

In just 129 days of 2021, a total of 5,450,544.3 ETH were withdrawn from centralized exchanges. That's 4.71% of the circulating supply👀

As well, 8.74% of the circulating supply of #Ethereum is currently locked in #DeFi Protocols pic.twitter.com/mfwmOnQq8W

EIP-1559 seems to have many thinking a bit longer term...

With exchange supply dwindling and EIP-1559 scheduled for integration, many might soon find the amount of ETH required for gas extremely difficult to accept. It’s one thing talking about Ethereum at $10,000 per ETH, but many are only just coming to realize just what interacting on the blockchain in its current state will entail. With a quick recent drop to beneath $3,500 at the time of completing this article, investors have a chance to reevaluate their ETH positions, and not just how sustainable they think activity on the network will be at current price levels, but how appealing and accessible it will be to newcomers to the decentralized internet of the future.