NFTs have changed how art is created and sold. They’ve even changed the way that people think about digital ownership. Although they aren’t new, NFTs boomed during 2021 as massive sales made the news and celebrities including Justin Bieber and Serena Williams leapt onto the NFT wagon. NFT was even word of the year in 2021.

This rise in popularity has led many to question ‘what is an NFT?’ and ask why these tokens are suddenly so important. If you’re taking your first steps into the space as a casual onlooker, artist or collector, here’s a complete guide to NFTs in 2022.

What is an NFT?

NFT stands for Non Fungible Token. The non fungible part means that every NFT is a one of a kind item: it can’t be replaced or replicated. Tokens are digital assets bought and sold using cryptocurrency (most commonly Ethereum). Scarcity is important and rarity determines an NFT’s value.

NFTs share much of the same underlying technology as cryptocurrencies. Unlike currency, though, their non fungibility sets them apart. A bitcoin, for example, is fungible. Each coin is equivalent to the other and therefore interchangeable. Since NFTs are strictly non fungible, one isn’t equivalent to the other and they can’t be exchanged “like for like.”

That core concept is crucial to understanding how NFTs function, why they’re important and why some are worth so much money.

NFTs explained

NFTs are a new way to sell and collect both physical and digital art. Each NFT is minted on the blockchain, which means that it comes with a digital record of ownership. As with any saleable commodity, a strong market has developed around the buying and selling of NFTs.

People collect for a variety of reasons. Some people simply love the piece, others want to invest long term in the artist, others buy with the intention of flipping. Flipping means selling an NFT in the short term for a quick profit. Although they might seem new, NFTs have actually been around since 2014 when Kevin McCoy minted ‘Quantum’ (which was recently sold for $1.4 million).

From an artist’s perspective, NFTs represent a new way to make a living from their work. They also cut out so-called “middlemen” and allow artists to reach their audience directly. The additional layer of security offered by the blockchain makes it easier for an artist to assert total ownership over their work.

McCoy’s ‘Quantum’ - the first NFT courtesy of Sotheby's.

How to buy an NFT?

To buy an NFT you’ll need three things: a cryptocurrency wallet, cryptocurrency and access to an NFT marketplace. Some NFTs are sold at a fixed price, others at auctions with a reserve price.

You’ll need to sync your wallet with your chosen marketplace and ensure that there’s enough cryptocurrency in it to cover both the cost of the NFT and associated gas fees. These are unavoidable and are used to pay for any action on the blockchain (in this case the transfer of a token to your wallet). Gas fees don’t go to the marketplace. Future blockchain developments will drastically reduce or even eliminate these fees.

After that, purchasing an NFT is as simple as clicking buy. When the purchase is complete, your NFT token will be transferred to your wallet where you’ll be able to see it alongside your cryptocurrency. From there you can hold and enjoy or make plans to relist the NFT at a higher price.

How to create an NFT?

Creating an NFT is easier than most people imagine! Despite the cutting edge technology operating behind non fungible tokens, making one is as simple as creating a piece of art, joining an NFT marketplace, setting a price and then “minting” (putting up for sale) said art.

You’re limited only by the scope of your imagination. Some of the biggest prices in the NFT world might be attached to collectables, but the space has expanded rapidly to incorporate any and every kind of art: painting, animation, poetry, music, film - it’s all there. The first step is to create your NFT, write up a compelling description and research which marketplace you want to sell on. OpenSea is a popular choice for beginners as it doesn’t charge gas to mint, but there are lots of other choices (see below).

The next step is to sign up to the marketplace and sync your wallet. When you upload your NFT you’ll be asked to create a description, add some tags and sign wallet confirmation. Most NFTs are sorted into collections for ease of curation. Creating a collection is simple too, just give it a name, a description, a banner image and you’re good to go. In just a few clicks you’ve created a brand new NFT - immortalised on the blockchain!

How to sell NFT art?

Listing your NFTs for sale is only the first step in a long process. Selling an NFT collection or single piece of art requires a coherent marketing strategy. Most NFT sales occur via Twitter (and in Twitter Spaces) or after meeting collectors on Discord.

The NFT community is incredibly strong on Twitter and Discord, less so on other social networks like Instagram and Facebook. It’s often said that marketing an NFT isn’t about marketing at all - it’s about building a community. Network with fellow artists, collectors and showcase your work. As the connections build, the number of eyes on your work increases. Twitter Spaces are a brilliant way to talk about your work in more detail.

As more people become invested in your journey as an artist, they’re likely to invest in your work too. Most collectors have an eye on longevity, so they need to know that you’re around for the long haul rather than a one off cash grab. A community shows your commitment and makes it less likely that you’ll simply vanish.

How to invest in NFT art?

Investing in NFT art means buying the right piece at the right time and holding until its price rises enough to sell on for a profit. The first BAYCs were purchased for under $200. These are now worth millions. CryptoPunks were free in 2017 but are currently valued at hundreds of thousands of dollars.

Choosing the right artist plays a big part in the success of the investment. An artist with a big following might seem tempting, but it’s not a guarantee that their work will accrue value over time. The NFT space is littered with stories of so called “rug pulls” where an NFT creator abandons their collection and leaves with the money, leading to a price crash. An artist who releases too often devalues existing work, one who doesn't release enough risks fading into obscurity.

Earning a place on a whitelist is one way that people invest. Whitelists give buyers early access to new collections, ensuring that they get the lowest price. If all goes well when the project becomes fully public and the price climbs, you would be sitting on a strong investment. Whitelists are usually made available on Discord chats and you’ll need to scour Twitter to find the right communities. Of course, whitelists are fraught with risk. Getting into a project early means doing so before public scrutiny has the opportunity to uncover any problems.

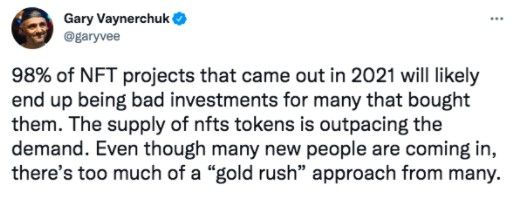

Even NFT oracle Gary Vee acknowledged that many NFT projects are likely to go to zero. Making the right choice is crucial. Look for an artist with a track record, a strong community and a roadmap that promises long term building. Any investment is all about balancing risk with reward and mitigating the former with extensive research.

Gary Vee has urged caution about investing without due diligence.

What’s the best NFT marketplace?

More new NFT marketplaces seem to appear every day, so it’s difficult to determine which is best. OpenSea is easily the biggest NFT marketplace and it’s where most beginners start their NFT journey. Other popular platforms include Foundation, KnownOrigin, SuperRare and (on the Tezos blockchain) Objkt.com.

There are a couple of things to consider when choosing an NFT marketplace. First, you’ll want to decide which blockchain to use. Ethereum is overwhelmingly the most popular choice, but rivals are catching at its heels. Polygon famously eliminates gas fees, Solana is gaining traction, Tezos promises a lower environmental impact and BNB is backed by crypto colossus Binance.

Not all marketplaces support multiple coins. You’re spoiled for choice if you want to collect using Ethereum with OpenSea, Rarible, Foundation and KnownOrigin being popular choices. Tezos is a little more limited but Objkt, Versum and hic et nunc are widely used. The Binance marketplace is currently the best place to spend BNB. OpenSea offers Polygon and is working on Solana integration.

Curation is also important. It’s a tricky topic in the NFT community (since NFTs are supposed to be as decentralised as possible) but a curated platform gives buyers a layer of additional security. Artists must apply to sell on these platforms and they usually need to be established. Of course, this sometimes means that you’ll miss out on hidden gems from unknown creators.

SuperRare is the most famous curated platform and has a rigorous selection process. KnownOrigin is also curated and artists must be approved. Foundation relies on community invites. OpenSea, Objkt, Rarible and many others are more open and allow anybody to mint.

What is the NFT environmental impact?

Traditional NFTs have a big carbon footprint. Mining cryptocurrency is energy intensive, as is making transactions on the blockchain. The picture isn’t as bleak as many people paint though. The cryptocurrency world is actively evolving to be more carbon efficient and even carbon neutral.

Tezos NFTs are frequently touted as “clean NFTs” due to the dramatically reduced carbon footprint of the blockchain. The annual global footprint of the Tezos blockchain is equal to that of just 17 people, making it much cleaner than any of the other big cryptocurrencies. Moreover, the arrival of Ethereum 2 is widely expected to solve ETH’s environmental problem.

We are likely in a period of transition as blockchain technology evolves to be much greener. Proof-of-stake (rather than the energy intensive proof-of-work), fewer on chain transactions (using Layer 2 technology) and running mining hardware on green electricity will all make a big difference. Proof-of-stake on Ethereum 2 alone is expected to reduce its carbon footprint by 99%. All of this means that the future of NFTs is green and fully sustainable.

What does NFT mean for the future?

The NFT crypto boom has led to claims that NFTs are a bubble set to burst. Although some people still believe that NFTs are stupid or a fad, they’re here to stay. Digital ownership will play a massive part in the future of the arts and NFTs will operate at the heart of Web3.

Huge companies including Nike, Coca Cola, McDonald's and Gucci have already created NFTs. Auction houses including the prestigious Sotheby's have hosted digital auctions. Hundreds of millions of dollars are held in the NFT market. Vast infrastructures and multitiered businesses exist around NFTs, meaning that entrepreneurs and investors are extremely optimistic about the future.

None of those businesses and organisations are going away any time soon. NFTs will open up new ways to produce, curate and sell art, as well as new avenues for musicians and new models for publishing literature. Even if the current buzz around NFT tokens lessens, it won’t fade away altogether.

If you still have your doubts about NFTs, remember that everything from bicycles to television, the internet and social media was written off as a fad in its early days. NFTs are no different. As more and more individuals, artists and big companies adopt NFTs as the norm, their popularity and prominence will only increase.