GameStop will build its much awaited NFT marketplace using Immutable’s Layer 2 Scaling protocol: Immutable X. As the two companies publicly celebrated their partnership this week, things were very different behind the scenes. While GameStop sung the praises of its new partner across social media, it was quietly busy dumping Immutable’s IMX token en masse, causing the price to collapse, netting a substantial profit and setting the markets ablaze with speculation.

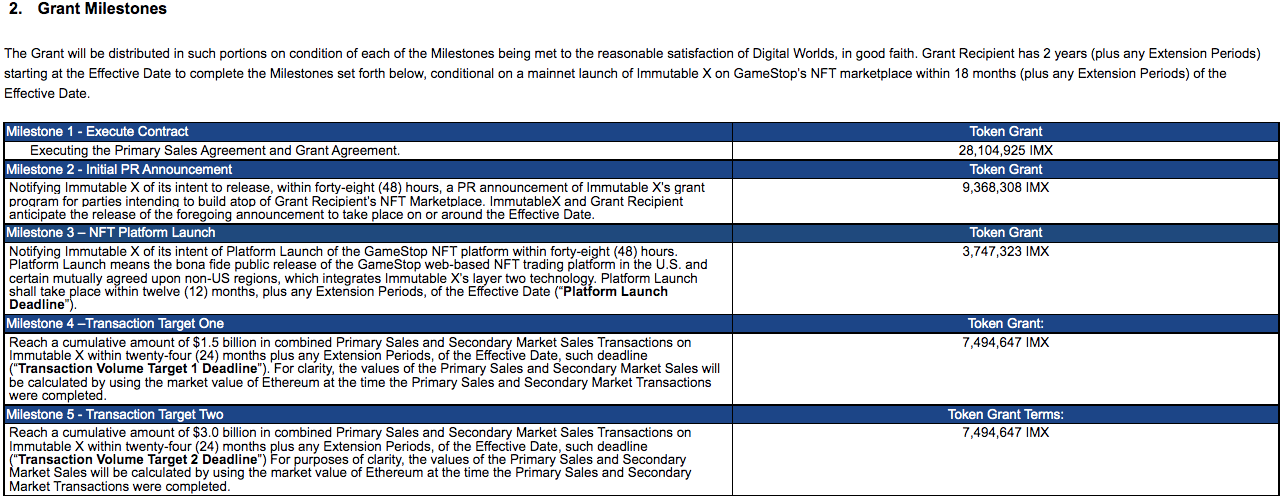

News of a GameStop NFT marketplace is nothing new. The company has been edging deeper into the NFT space for months and has been vocal about its ambitions. Its marketplace will (unsurprisingly) be focussed on gaming and comes with a lucrative $100 million dev fund (in IMX tokens) to entice new developers into the space. So far, so good. As part of the deal, Immutable will pay GameStop a total of 56.2 million IMX tokens according to the progress of a roadmap that works towards the eventual launch of the marketplace. As GameStop met the latest step, they were duly transferred nearly $100,000,000 worth of tokens.

That’s when things start to get more contentious. Within a matter of hours, GameStop had dumped around $300,000 of those tokens, with the transactions plainly visible on Etherscan. The dumps were strategic and timed to coincide with a series of announcements about the partnership. Whenever a new announcement was made, IMX prices would surge, at which point GameStop dumped, causing it to crash all over again. What makes the move so astounding is its clinical nature. GameStop used the hype around its marketplace to deflate its partner’s price, dumping on token holders at what should have been a triumphant moment for both parties. The sales were conducted on Huobi, OKex and Binance and initially brought to light on Twitter.

In total, the sale brought GameStop $47 million and drove its share price up 3%. Conversely, IMX plummeted to a lowly $2.99 against a previous surge high of $4.13. This led market watchers to conclude that GameStop effectively crashed its new partner, hardly the best start to a working relationship. With the transfers laid bare on Etherscan and Twitter abuzz with opinion, neither GameStop nor Immutable have so far commented. GameStop still holds around 22.5 million IMX tokens, but for how long remains a mystery. It’s entirely possible that, when IBX’s price recovers, GameStop will simply dump again.

That’s not even the end of the story. With GameStop due a massive 56.2 million IMX tokens, this initial sell-off might prove to be just a small drop in a very deep, very liquid ocean. The next milestone on the roadmap is reached when GameStop launches its NFT platform. That will see a transfer of another 3,747,232 IMX, possibly accompanied by a flurry of dumps and a price pummelling. Many will be watching with bated breath, not least Immutable itself.

Immutable has a long history with NFT gaming that makes it a perfect match as GameStop carves out a space in the sector. It’s the developer behind Gods Unchained (which spawned the $GODS token) and Guild of Guardians. The company made waves earlier this year when it secured 60 million dollars of funding for an NFT gaming platform. Immutable X has obvious attractions. It promises carbon neutral operation, zero gas fees and lightning fast processing. It can handle 9000 transactions per second, more than enough to cope with the demands of a gaming marketplace.

That's good news because GameStop has big ambitions. Collectables like character skins and weapons will form a large part of their marketplace experience, but insiders suggest that there will also be virtual real estate up for grabs. The developer fund is a statement of intent, designed not just to entice new devs but to emphasise GameStop’s long term commitment to the sector. It might be much needed, too, because NFT game development has so far been tentative at best. Big name studios have floated the idea of NFT projects only to quietly shelve them after negative reactions from fans.

Zero gas and carbon neutrality are big draws, but it remains to be seen whether they’ll be enough to encourage large numbers of developers to fully back GameStop’s vision. For the time being, attention is centred on the token dump. It’s an unwelcome distraction at a time when the narrative should be focussed entirely on the new marketplace and its potential. Whether those big dumps will have an impact on developer confidence remains an unanswered question. Whatever happens, investors will be keeping a close eye not just on GameStop’s current IBX holdings, but on what happens when it hits the next milestone.