Yuga Lab’s Otherdeed mint was always going to be massive. As the dust settles on the most seismic drop in NFT history, the numbers are boggling. $320 million was raised for the 55,000 plots of available land, but prices are already up x4 on the secondary market and continue to rise. Gas fees soared as high as 2 ETH, people paid thousands for failed transactions and the Ethereum blockchain buckled under the strain.

The biggest mint in NFT history

Yuga Labs has already branded Otherdeed the “largest NFT mint in history by several multiples” and few would argue. The NFTs represent plots of land in the upcoming Yuga Labs Metaverse game Otherside. A single plot set buyers back around $5,800 plus gas. The price of $APE had been climbing steadily in the days and weeks preceding the drop as prospective buyers queued up to grab a slice of history. Collectors were informed in advance that they could only use $APE to purchase, although ETH would be needed to cover gas fees.

There was also a KYC requirement (buyers had to hold their ETH and $APE in the wallet that they used for KYC). The sale was originally planned as a Dutch auction to ease blockchain congestion and keep gas fees down. This idea was scrapped and replaced with limitations on how many deeds could be purchased per wallet: just two. A high clearing price of 305 $APE was also put in place.

These measures were supposed to keep network congestion to a minimum but they either weren’t adequate or demand was simply too high. The Ethereum network was hit by significant disruption, transactions failed and gas prices soared to above the value of the Otherdeeds. It cost roughly $6000 to mint a $5800 NFT - and that was even if the transaction went through. Yuga Labs has since apologised for “turning off the lights on Ethereum for a while.” They also promised to refund gas fees to anyone whose transactions failed in “the bottleneck.” Other big drops have caused congestion and pushed fees up, but this is the largest disruption in the history of ETH.

The cost of hype

None of this should come as any surprise. Hype surrounding the mint couldn’t have been much higher. Even OpenSea got in on the action, sending mass emails to inform users that it would now be accepting $APE to buy deeds on secondary. Yuga Lab’s valuation rose to nearly $4 billion when the metaverse game was announced. A recently released trailer suggests that Otherside will be an MMORPG. Players will use their NFTs as avatars and playable characters.

Yuga Labs hasn’t released many other details apart from confirming that they’re working with numerous game studios. Nicole Muniz, CEO of Yuga Labs, boldly claimed that Otherside will render “all other metaverses obsolete.” Combine this with the success of BAYC, soaring $APE prices and hype flooding in from seemingly every angle, and it’s not difficult to see why even the Ethereum network couldn’t cope with the strain.

The deeds sold out almost as soon as they went on sale. BAYC and MAYC holders will be able to claim their deeds within 21 days. Yuga Labs also added that the ApeCoin generated from the sale would be locked away for a year, meaning that it won't affect voting in the ApeCoin DAO. Intriguingly, the price of $APE has since plummeted, perhaps because secondary sales on OpenSea can be conducted using ETH, depriving some of the utility-focused coins of their utility.

Was this a successful mint?

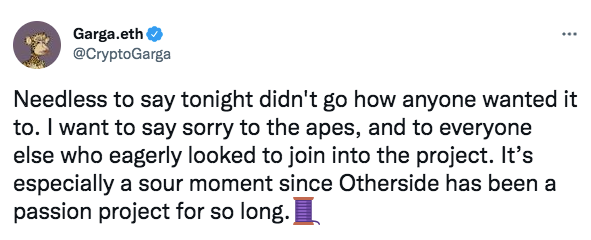

Despite a rapid sell-out, the mint left a bad taste. Even BAYC co-founder Garga admits that it was a “sour moment” and “didn’t go how anyone wanted it to.” As gas fees and failed transactions mounted up, users took to Twitter to voice their displeasure. Many expressed disbelief that a team as prestigious as Yuga Labs could allow such a chaotic mint to unfold. One person complained that the saga cost him 2 ETH in gas and 2.5 hours that he could have spent with family. Another claimed to have spent 3 hours waiting for gas to be affordable, only to give up. Many, many more lamented their failed transactions. Others took a more humorous tone and dubbed April 30th as the day of The Great Gas War.

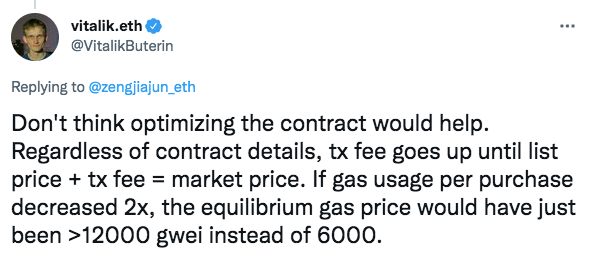

The mint cost nearly $100 million in gas and there was also criticism for not incorporating many gas optimisation techniques. On this point, Vitalik himself waded in to suggest that contract optimisation might not have made any difference and the problem was market-based. This led other users to conclude that the mint itself was flawed.

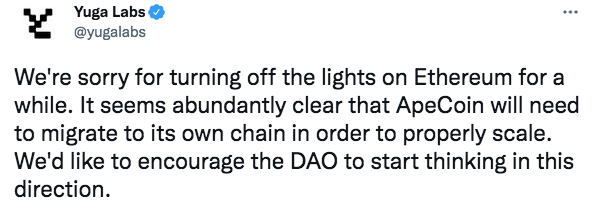

Looking to the future, Yuga Labs obviously feels that it's outgrown its current infrastructure. The team suggests that it’s now “abundantly clear” that ApeCoin can only scale on its own chain, a move which will have to happen sooner or later. That appears to be the future, and they urged their DAO to start thinking about how this could be implemented. Everybody involved in last night's mint will probably be counting the days.

Read more:

5 Things You Didn't Know About ApeCoin

Sotheby's BAYC

Don't Whitelist Before You Read This