... I had no idea and learned very quickly that I chose wrong.

So when new NFT artists contact me to show off their new work and tell me about their first sales, it is bittersweet to see them being successful and finding their first buyers to then find out that they are minting in a default collection. And many do not understand why this can be a problem.

So let's talk about collections & contracts and why it is so important that every crypto artist owns their own. The big point being: second market royalties.

Short side note before we dive more into this: like most NFT artists, I had to learn about NFT collections and smart contracts myself and I made some costly mistakes while doing so. This might not be perfect, but I tried my best to collect as much information on this topic so other artists don’t have to repeat my mistakes. Or at least be aware of them beforehand.

Also - this is in no way a rant for or against any platform. We love them all. Here we go.

In general, there are two types of NFT markets:

1. Open Markets like Rarible and OpenSea where you can just start releasing your art.

2. And selective Markets like SuperRare or Foundation that have some kind of gated access.

In my experience, all of them fail to explain upfront how royalties would behave outside of their platforms - and that is the key. Remember, with tokens being released on the same blockchain, in this case, Ethereum, they can be resold on other platforms after your initial sale.

OpenSea offers the most attractive and cheapest plan for new artists. Their "lazy minting" strategy option gives the artist the option to only pay one fee for the first mint and every NFT mint after that gets paid when the item/token gets bought. They do this because the actual minting only happens when the sale goes through.

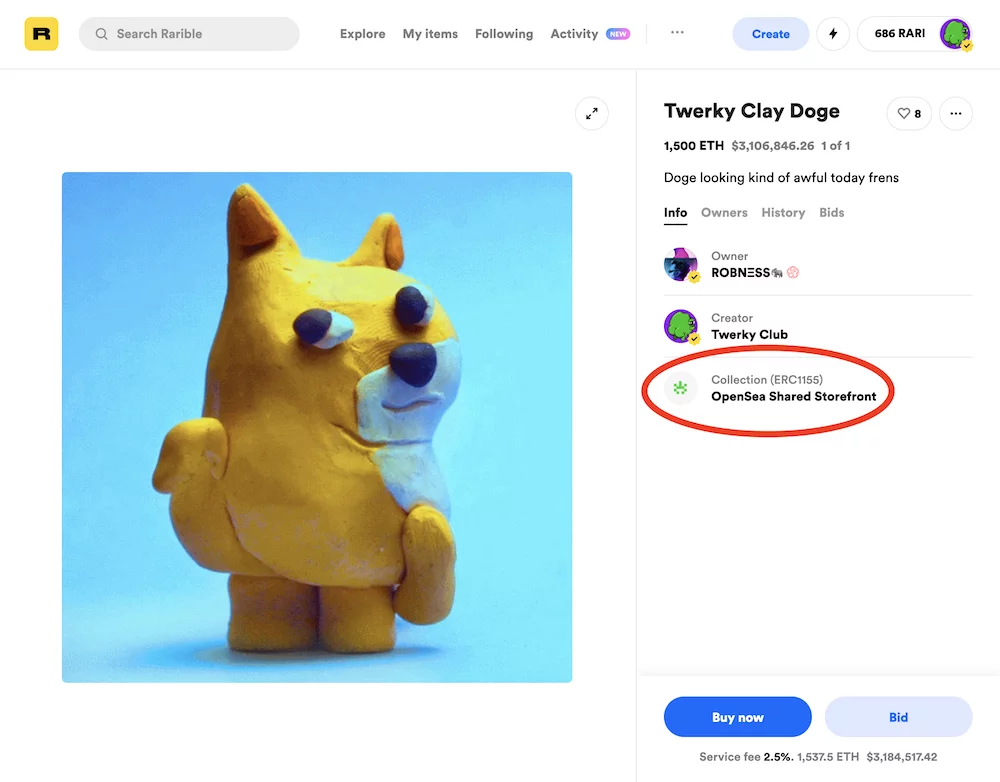

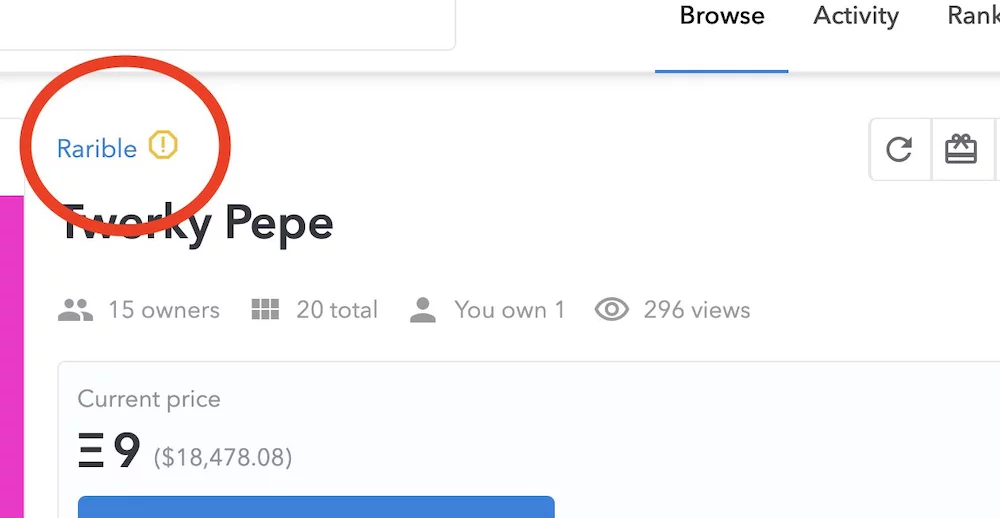

Once this happens, the item gets minted to an OpenSea collection, although on OpenSea it looks like it is in the artist’s collection. You might say - Twerky, what’s the problem with that? As long as you stay on OpenSea, there is none. But you cannot control where your collectors offer the item for the second market. Sure, Opensea is the most attractive market, but if the collectors sell this item on Rarible, you won’t have access to the royalties of the secondary market sale. They go to Opensea and not to you.

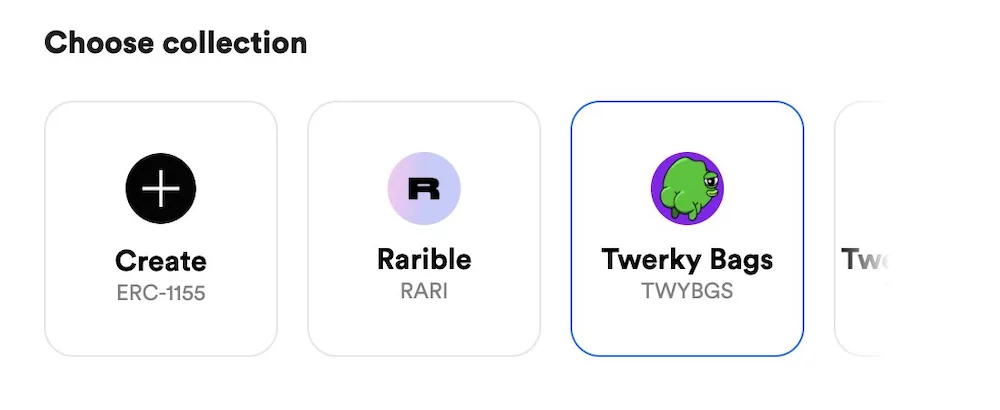

Rarible on the other hand only offers the opportunity to mint in their default collection or to create one for yourself. The big difference to OpenSea is that the artists need to pay the minting right at the start. To avoid paying for minting might be attractive for some collectors but it is a risk for the artists.

Before you decide which collection you create, you have to know if your collection will only consist of 1/1 items or you will also include items that have multiple copies.

For only 1/1 collections, you should choose the ERC-721, otherwise go with the ERC-1155.

Be aware that some OG collectors do not buy NFTs from ERC-1155 not only because ERC-721 is more bougie, but because it is a guarantee that the whole collection hosts unique NFTs.

Now let’s talk about Selective Markets

As far as I know, most selective markets like SuperRare and MakersPlace only let the artists mint in their default collection - with one exception being Niftygateway, which seems to offer more options. This means that the artist can only see royalties if these sales happen inside the platform where they were minted and the artists need to pay for the minting as well.

Considering the curated artists approach selective markets have, they should be the first ones to offer their artists the ability to mint their work in their collections. On the other hand, there is a point that having your work be part of the SuperRare Default collection being seen as a guarantee for special status.

I want to give a quick shoutout to platforms like withFND that give artists the ability to invite fellow artists. That’s the best balance of quality vs the real purpose of blockchain.

You might ask me now “But Twerky, I am new and I do not want to risk money for an NFT that may not sell. What should I do?”

Well I can only talk about my own experience and I would recommend:

1. If you are just starting and don’t have a lot of money, start releasing in a default collection on either Rarible or Opensea and just evaluate the pros and cons.

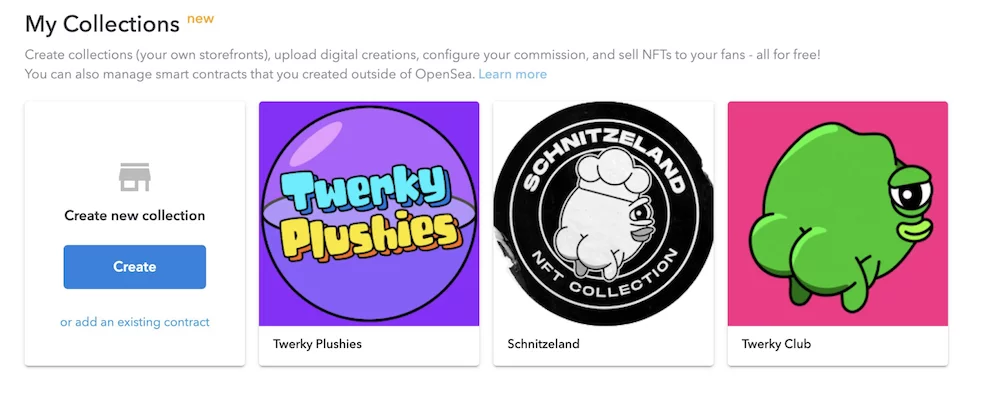

2. Once you see some sales and can confirm interest in your collection, re-invest the money you made with your first sales back and buy your collection on Rarible. After you mint your first NFT it will be shown in your OpenSea account as well. Be aware that the first mint in your collection will be expensive so be ready.

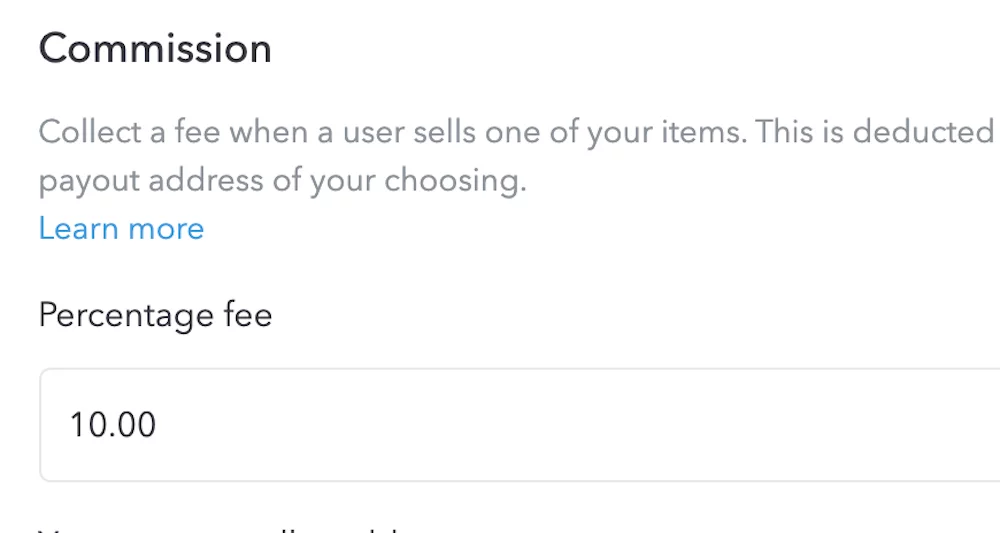

3. Right after your first mint in your collection, be sure to go to the collection page in Opensea and set the commission/royalty value to be sure your NFT will properly generate the fee no matter where it gets sold.

As collections are not cheap, there are tools out there that monitor the current prices like https://tools.gravityenterprises.co.za/#/Cost by @FallenGrav1ty from Rarible

Once you made the transition from default to your own collection, be sure to show your NFTs in the easiest way for your collectors. I do it through my website that has helped me to keep my frens updated on the status of the collection and other side projects:

www.twerky.club

Mad love to you frens!