Life Saving Digital Asset Analytics - Know Your Market

So What’s The Value Addition Factor?

With increased exposure to digital transactions, Cryptocurrency has witnessed a recent hike in investments and trading. A paradigm shift in global finance and market conditions have enabled the crypto market to boom with several organizations and independent traders engaging in investments. Along with this growth arises several troubles that need immediate solutions. To tackle such issues organizations and traders need to understand the recent market trends and make smarter decisions. Data analytics provides a secure framework of transactions and allows individual investors to determine suitable market conditions and invest accordingly.

“Being A Smart Shopper Is The First Step To Getting Rich” - Mark Cuban

The digital market has become very competitive in the recent past. As there are loads of projects and artworks out there, it becomes very important to know which one would be the right choice. As the digital assets markets are very much volatile at the moment the question of when and where to invest becomes a huge “?”. A large number of people end up making huge losses or investing in the wrong tokens/NFT’s due to a lack of knowledge and analysis. In that case in order to avoid such loss, before investing one must be aware of market conditions, predictions and various other parameters. various market analysis platforms can give answers to a wide range of queries which would help in improving the decision making.

Lets Dig Deep

There are countless NFT projects in the market and the rate at which NFT are being minted is increasing rapidly. It's just like being in the middle of the woods. Few key metrics that can help you make a wise decision have been given below.

Rarity Score

Rarity score - A metric created by Rarity to measure how valuable the NFT collection can be.

NFTs with higher rarity scores are usually more valuable than those with lower rarity scores. Rarity.tools is a website dedicated to ranking generative art and collectible NFTs. Rarity is one of the most important factors in determining the value of an individual NFT.

With this information, NFT collectors can more easily value and compare the value of individual NFTs against each other.

Volume Traded

The total volume traded is a key metric for analysis. The period of analysis can be optional. This is available in Rarity and Opensea.

Meanwhile, the opensea’s trading volume increased 286 % from July to August and has seen a $1.23 billion volume this month already.

Estimated Market Cap

One of the most important metrics is Market cap. This can be calculated by multiplying its average price by its total supply.NFT markets are generally less liquid and move a lot slower than fungible tokens. This is mainly on account of the difficulty in finding a buyer willing to purchase your NFT. A high estimated market cap means that there are more owners of the tokens and they may be willing to pay a higher price to acquire the NFT collection.

Rarity.tools might be a good choice to serve the purpose

Long Term Believers

Metric used to measure the strength of the foundation is to know the number of owners who have not sold their first NFT collection. This is a useful indicator for identifying projects with true long term believers.

A tool that you can use for this is Nansen Analytics.

Hodlers

It is always good to know the total number of holders of an NFT. The more the hodlers, the more it influences potential buyers.

Dune analytics can be a good suggestion

Let's Take A Quick Drive Into Various Analytics

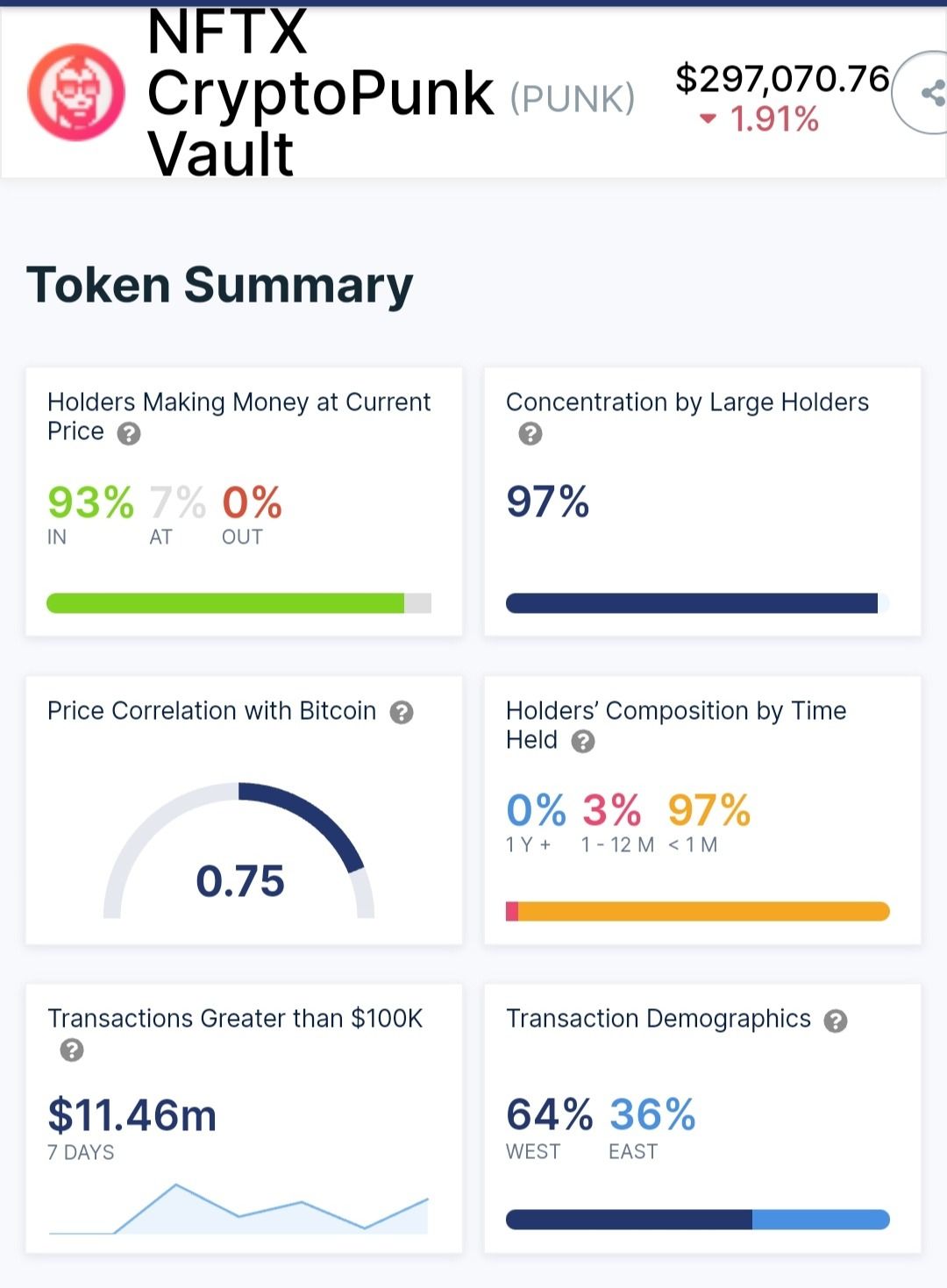

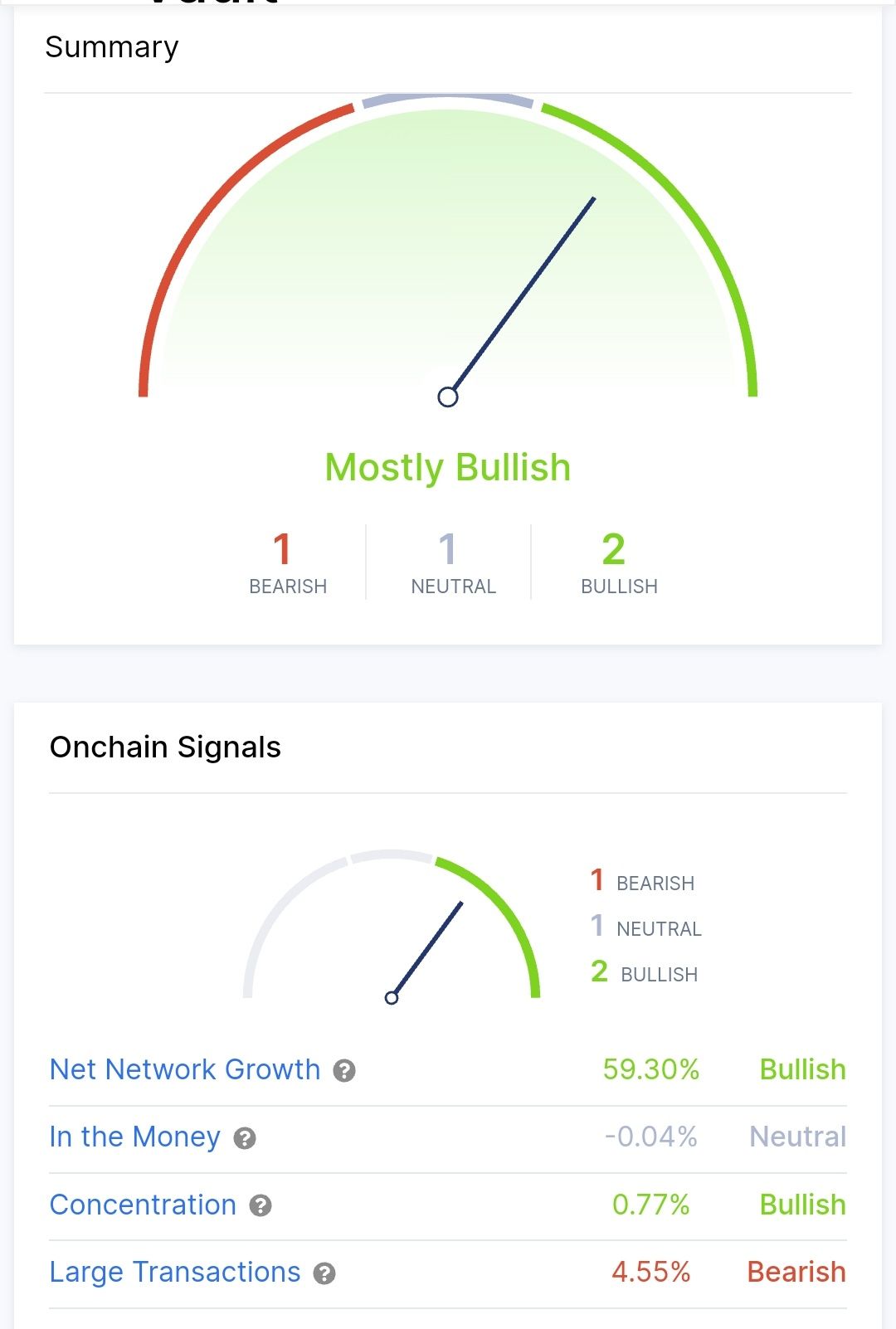

Intotheblock platform was built with the intention of finding answers to the unanswered questions in the digital market. And yes they have answers to most of the questions. They have analytics from all spheres of blockchain, crypto and NFT’s.

Dune A Collaboration Of Efforts

Dune Analytics is a powerful tool for blockchain research and has unique features. Dune gives you all the tools to query, extract, and visualize vast amounts of data from the blockchain. Dune is unleashing the power of public blockchain data by making it accessible to everyone. While navigating Dune Analytics, it helps to have a good understanding of queries. Dune transforms difficult to access data into human-readable tables. Dune also gives you access to other user’s public queries so you can pick up where they left off.

Just Query Is All You Have To Do

Queries

Dune aggregates blockchain data into SQL databases that can be easily queried. Queries are used to specify what data from the blockchain should be returned. Queries return rows and columns of data (same as traditional SQL queries) that can later be visualized and presented.

Visualisation

Visualisation takes the queries and converts the results into clear, precise and presentable.

To get more insights into how people use Dune, you can follow our Twitter account where we retweet the most interesting things that happen on Dune.

We are on a mission to make crypto data accessible💫

— Dune Analytics (@DuneAnalytics) August 12, 2021

Meaning every single metric from every single data source easily available to the community for free👌🤯📊

The data must flow and therefore we've raised a:

🚨 $8M SERIES A LEAD BY @usv🎉🧙♀️

🧵👇https://t.co/MgHEKYGhKG pic.twitter.com/3PRMNCfTLr

There are a lot more potential Market analytics which can provide you metrics and true insights to a wide range of assets. A few of the well-known platforms are mentioned below.

- Glassnode

- Evaluate Market

- Cryptoslam

- Nansen

- Rarity Tolls

- Rarity Guide A

Let's Build A Safe And Healthy Ecosystem

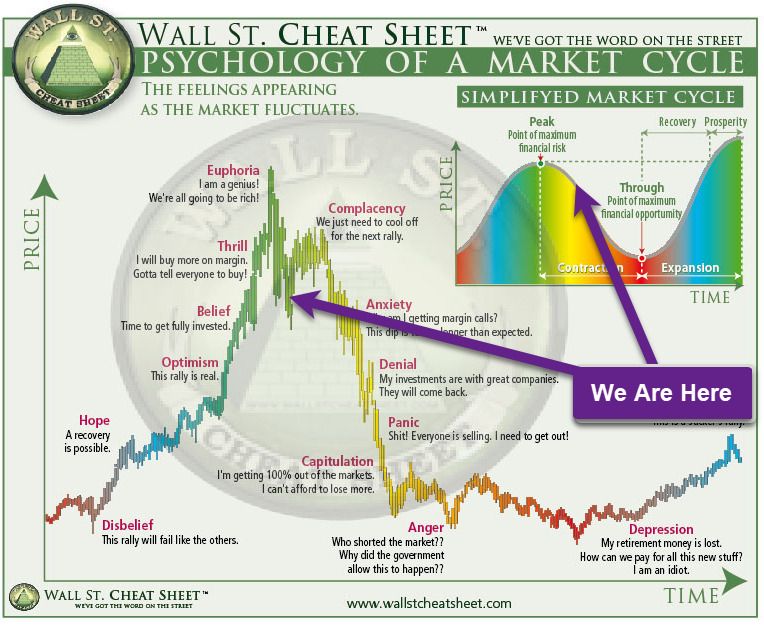

A strong ecosystem can only be built with strong individuals. To create such an ecosystem strong analytical skills are pivotal. People who don't make data-driven decisions mostly end up making losses. Using analytics, investors get clean insights on the performance of previous strategies and study them to understand why results have been shaped in a particular way. By analysing previous performances, investors can avoid making similar mistakes in the future.

NFT Statistics

NFT’s Biggest Question - Sell Or Hold?

The question “How to sell the NFT’s at the right time?” is unanswerable. Many times people sell out early and miss out on huge profits. Sometimes people just hold. Now the new scheme seems to be to wait for the projects to be sold out. Then analyse which way the market moves. To play on the safer side take profits before some serious pullbacks.

Speculators pile in and NFT Sale Surges.

speculators bet growing interest across the art, sport and media world keeps NFT prices rising.

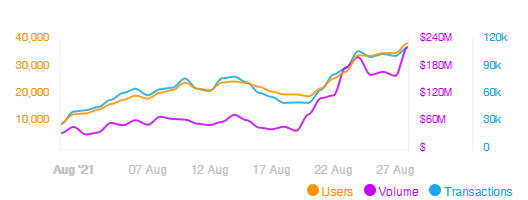

Opensea Statistics From DappRadar

NFT Mania Sends Ethereum Gas fees skyrocketing reaching a 14 week all-time high.

Etherscan - Eth Gas Price

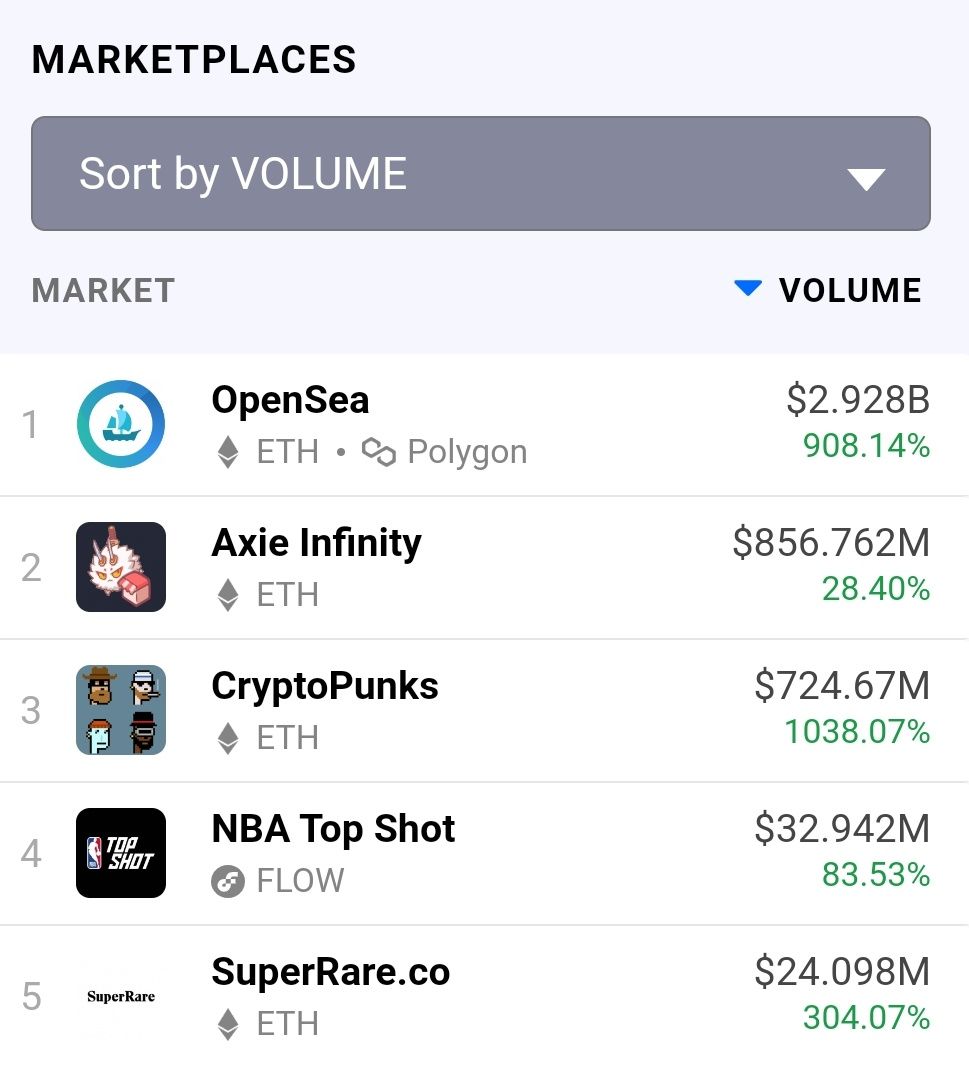

Top trading platform for the month based on trading volume.

DaapRadar