Gem, a marketplace aggregator where buyers can purchase NFTs from multiple marketplaces, has been purchased by OpenSea. This move has created much controversy in the NFT space, a space which sprung up in reaction against overly centralized power. What does this mean for the NFT marketplace going forward, and what are OpenSea’s plans for the future?

About Gem

Gem is a platform that makes it easy for users to list, buy and sell NFTs on multiple marketplaces at once. As part of this, Gem allows users to buy multiple NFTs at once, rather than one at a time, and helps them save on gas fees – which is an ongoing issue with chains like Ethereum. And as if that wasn’t enough, Gem allows users to pay with ERC-20 tokens instead of ETH, making it hugely convenient to trade NFTs.

If you haven’t heard of Gem before, no worries — Gem only launched to the public in January 2022. However, thanks to its user-friendly interface and gas fee efficiencies, it quickly became popular among NFT enthusiasts. The fact that OpenSea has acquired it after only three months of public operation really says something about how swiftly things move in the NFT space. Just when Gem is getting wider recognition and popularity, it’s already been snapped up by a larger, more established entity.

Currently, Gem supports trade with OpenSea, Looks Rare, NFTZ, and X2Y2. The platform recently added sudo integration as well, and plans to expand integration with other marketplaces, such as Foundation and Coinbase.

Generating a lot of positive buzz from users in its first few months of public operation, Gem was clearly a rising star in the NFT trading space. Now that it will be in the hands of OpenSea, its fate is uncertain.

No Gem drop - not yet

One immediate effect of this acquisition is the cancellation of the teased Gem airdrop. Previously, Gem had teased releasing its own token, but now that OpenSea has acquired it will be delayed or might not happen at all. It’s possible that OpenSea may launch its own token in the future, but at the moment such plans are unclear.

In its announcement, OpenSea claimed that the way Gem is run won’t change, saying that “the acquisition will accelerate Gem’s roadmap for advanced users, and let us learn from their expertise, and bring in some of Gem’s top features to OpenSea.” Sounds good, right?

For its part, Gem has also assured users, writing on Twitter, “the Gem you know and love won’t change a bit.” Gem also reiterated that this will be only a good thing, looking forward to improving the user experience.

OpenSea also mentioned in their press release letting go a member of Gem’s leadership team, known as Neso, as part of their diligence upon preparing for the acquisition. No further details are outlined, likely to protect privacy and prevent controversy. However, this was likely included in the announcement to pre-empt any future revelations about this individual that may surface.

Crypto community reacts

Reactions among the crypto community have been mixed. Some have responded positively with words of congratulations, “LFG” and “smart move” posted in response to OpenSea’s announcement tweet. The far more vocal comments, however, have been negative.

Some of the negative comments are reactions to the fact that there won’t be a Gem airdrop anytime soon, if at all, as hype and anticipation had been building for it. Others expressed fear that now Gem will be ruined.

Many have also speculated about OpenSea’s motives for acquisition. Crypto influencer Scott Lewis called the acquisition a “catch and kill” tactic, in which a larger company buys a startup for the purpose of absorbing its innovations and customer base, eventually retiring the startup arm in favor of its own adapted branch or service.

Twitter users also expressed skepticism at Gem’s continued quality UX. OpenSea infamously has customer service issues. A day after the acquisition was announced, problems with SuperRare listings disappearing from Gem were found. While this isn’t the first time SuperRare listings have had technical issues on Gem, the coincidence didn’t pass users’ notice.

Monopolistic Practice?

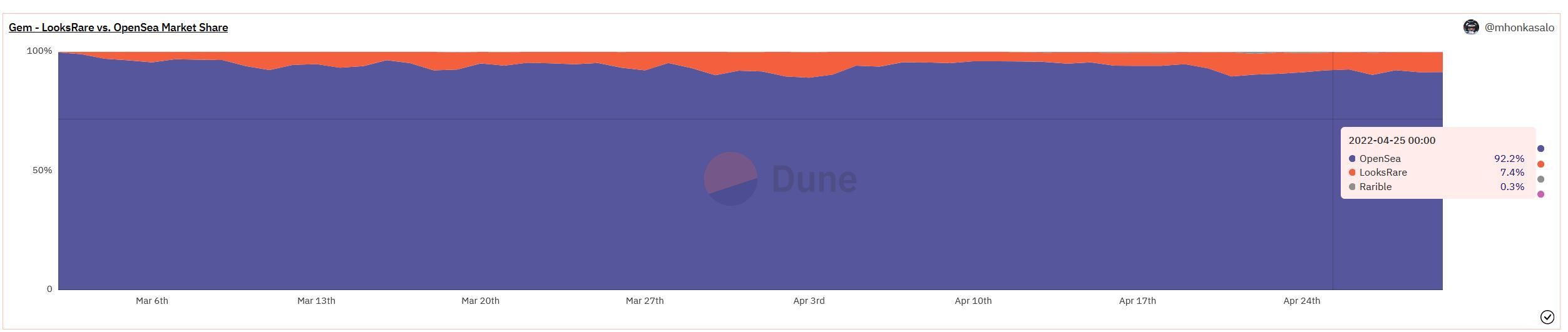

OpenSea, as a company with over 200 employees, is currently valued at over $13 billion USD, and as the largest NFT marketplace, it has the lion’s share of the NFT marketplace business. This is no small company, but an established brand. OpenSea therefore has a lot of power in the NFT trading space.

Many of us in the crypto and NFT space came to Web 3 in hopes of creating a decentralized system without power concentrated in the hands of a few corporate entities. The increasingly centralized media and internet landscape, we believe, has stifled innovation and narrowed the scope of creativity and possibility. Not to mention concentrate power.

This acquisition smells of the old Web 2 way of doing things: snap up something great before it becomes your competition, or before your competition gets it. Thus you further secure your place in the market and grow even more in reach and largesse. The difference is that the timeline is mere months, rather than years. Facebook acquired Instagram, for example, two years after the image-sharing app launched.

Is OpenSea attempting to corner the market by acquiring Gem? Definitely. OpenSea is a large corporation, and acquisitions will help cement its place in the NFT space. Now that OpenSea is intermingling with other marketplaces, it’s a question of whether OpenSea will undercut its competition by, say, charging extra fees to buy from other marketplaces via Gem, or dissolve Gem altogether.

The worst part is that users lack power to protest or resist, left only to attempt avoiding using OpenSea or Gem if they object. While there may be no immediate negative effects, the effect on the collective innovative space can be chilling. We’ll be watching what OpenSea does with Gem closely to see what they really want to do with the startup.