A Royal Decree

Her Majesty’s Treasury, the arm of the UK government that handles financial affairs, placed a call for evidence that ran from January 7, 2021, to March 21, 2021, about the benefits and disadvantages of regulating cryptocurrency, namely stablecoins, as a recognized form of payment. Over a year after the conclusion of that call, on April 4, 2022, the UK government officially gave its response: LFG!

The official document, the UK regulatory approach to cryptoassets, stablecoins, and distributed ledger technology in financial markets, is a 40-page thriller filled with surveys from respondents and structural implementation strategies, but just in case you’re not a fan of reading regulatory frameworks, I’ve touched on all the important points for you.

Stablecoins: Tanking at the Speed of Inflation

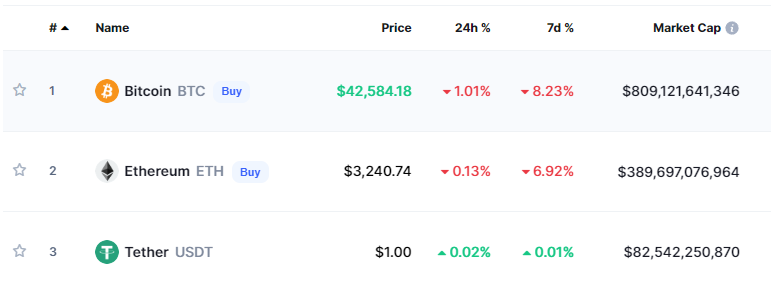

For those out there unsure what a stablecoin is, here you go. Essentially, it’s a coin that’s pegged to an off-chain asset, such as fiat. The most popular stablecoin out there is Tether, which is currently number three for market cap amongst cryptocurrencies. Tether is pegged to the US dollar. Oftentimes, traders will use stablecoins like Tether to move money out of a volatile crypto market and into the more stable fiat market without cashing out and creating the tax burden.

What the UK government has up its sleeve is regulating stablecoins as an alternative payment method. This very well could signal the end of paper money (and the end of that tax loophole). The cost of producing, transporting, and handling paper money, let alone change, is NGMI. The UK won’t tell you how much it costs to mint coins, but in the US, it costs almost 2.5 cents to make 1 cent, and the costs for major companies to manage and handle paper money only get higher as the value of the money they’re handling goes lower.

Stablecoin implementation is a unique solution. It offers all the modern conveniences of P2P transfers and a public ledger without the hair-pulling dips and agonizing volatility that comes along with Bitcoin and Ethereum. By early regulation, HM Treasury can set a precedent for the crypto tax system, which would largely be amended off the framework for the Banking Act of 2009, the Electronic Money Regulations of 2011, and the Payment Service Regulations of 2017. Since they’re just building off what they already have, expect everything to be fast and furious. They specifically mentioned that there’s general agreement that the framework for stablecoins will need to be flexible enough to respond to rapid innovation. Next month, the Financial Conduct Authority will be hosting a CryptoSprint (a hackathon?) with industry participants on how this whole thing will work.

Can’t Have a Coin without a Wallet

Besides just stablecoins, HM Treasury is also looking into the use of Distributed Ledger Technology (DLT) for enabling tokenization. What they found so far was, “These small-scale tests showed the potential of DLT-based systems to deliver securities issuances more efficiently; faster and cheaper, when compared to traditional issuances, while increasing the transparency of ownership.” Anyone on Twitter could have told them that. Basically, the big difference between DLT and traditional systems is that DLT is decentralized. This makes it challenging to implement on top of legacy systems and is listed as one of the potential drawbacks.

In response, HM Treasury is designing a Sandbox where fintechs and firms can safely test innovative products before they hit the wider mainstream. This creates a centralized ‘safe space’ to catch any bugs and billion-dollar hacks before they happen, and lessons learned in the Sandbox would then be used to support further legislative and technological changes. They’re looking to complete their Financial Market Infrastructure Sandbox by 2023.

Doxxed Founders? Check!

The Royal Mint is also minting a royal NFT! They’re going to be doing it in the summer to represent the UK’s new stance on cryptocurrency. Something like a commemorative coin that you can show your grandchildren and have them be super jealous that you were alive at the time that the Royal Mint was minting a sweet ass NFT. Hopefully, it’s cooler than that corny blue image in their tweet, which looks like I’m listening to music on my phone and the band ‘The First Ever’ came on playing their hit song, Royal Mint NFT. HM Treasury has done a fantastic job at positioning itself to be the global hub of cryptocurrency by polling experts in the industry and deep-diving into the intricate details of DLT. Now let’s hope they hire some fucking artists for their NFT.

Notable Quotes

Here are a few more things they talked about…

2.40 Despite prioritizing regulation for stablecoins used as a means of payment as an initial step, the government considers that additional regulation of a broader set of cryptoasset activities, particularly as a means of investment, should form a second legislative phase.

Translation: They got Bitcoin and Ethereum on their radar. Later this year, they’ll be doing further consultation on adding in our two fan favorites.

2.24 A number of respondents noted concerns relating to the environmental impact of certain cryptoassets…In this context, the government notes that some stablecoins may be based on ‘proof of stake’ blockchain systems and may not face energy-consumption issues which typically relate to the ‘mining’ or proof-of-work process underpinning certain cryptoassets. The government welcomes the efforts of some cryptoassets to move to more energy efficient ‘proof of stake’ processes.

Climate change is, and will most likely always be in my lifetime, a top priority, and the UK government doesn’t want anyone to think it’s forgotten that. They are signaling early that they strongly favor ‘proof-of-stake’ over ‘proof-of-work’. For stablecoins, this doesn’t matter a whole lot as the value is pegged to an off-chain asset, but for the two big boys noted above, Bitcoin’s PoW will inhibit widespread adoption, and Ethereum’s migration to PoS will be closely monitored.

USA! USA! USA!

The UK may be the first major world power to publicly adopt the integration of cryptocurrencies into their financial system, but the US isn’t far behind. Sen. Pat Toomey (R-Penn) believes as the UK does that, there’s a real possibility that stablecoins could be adopted in the physical economy. In draft legislation, Toomey has proposed a set of stablecoin regulations that would mandate routine audits, clear redemption policies, and disclosures regarding reserve assets backing stablecoins. He also made a case for stablecoins over the need for a digital US dollar because they are already here, whereas a digital US dollar would have to be created from the ground up and may not have the same amount of trust that Tether has already built.

But not everyone’s on board. Michael Hsu, the acting chief of the Office of the Comptroller of the Currency, sounded some alarms when he talked about the lack of interoperability into mainstream legacy systems. There’s also the fear of programable money controlling more of our daily lives. With news that the Chinese digital yuan has entered its third round of testing, major privacy watchdogs have sounded alarms over the dangers of programable money in society and governments’ control over the surveillance of spending. No more keeping bug-out money stashed in a shoebox buried in the backyard. That will soon turn into a Monero wallet with a seed phrase that you memorize and never write down.

Will we all be transferring money through QR codes to buy stuff in the future? Maybe. Many places are virtually cashless already, utilizing credit and debit cards for almost all purchases. How long will it be until crypto is accepted in as many places as VISA, and how much longer until paper money becomes as old as bartering with a goat?