As the popularity of NFTs (and their profit potential) has soared, so have the number of worthless or just downright scammy NFT projects. The good news is that most of these projects are just waving around giant red flags for anyone who knows to look. Here are nine of the biggest red flags to watch out for.

The Team is Unknown or Undoxxed

The team behind any NFT project is what helps get it off the ground (or floor, if you will). While the team doesn’t necessarily have to be undoxxed to be legit, you should at least have an idea of who they are. If there are no names behind the project — pseudonymous or not — that’s an even bigger red flag. Anonymity can be a wonderful thing, it can be a cloak that serial scammers hide behind to keep their identity (and their scams) concealed. No names, no accountability when things go south.

Unclear or Unrealistic Roadmap

It seems that a lot of NFTs have to have a road map these days. But the fact that a project has a roadmap doesn’t mean it’s any good. And unless they have outlined clear goals that can be easily evaluated and achieved, the roadmap isn’t much of a roadmap at all. It’s more like a list of things we would like, rather than an actual plan.

NFT and Corvette giveaways, big donations to charity, IRL VIP perks, a clubhouse in Bali… these sorts of roadmaps are vague on the procedure and timeline for a reason.

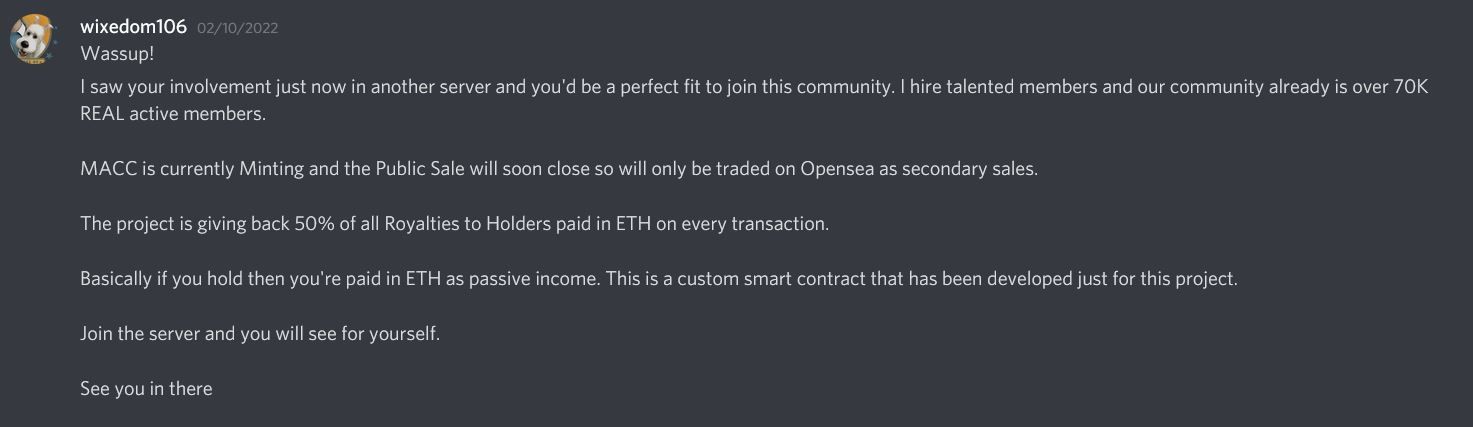

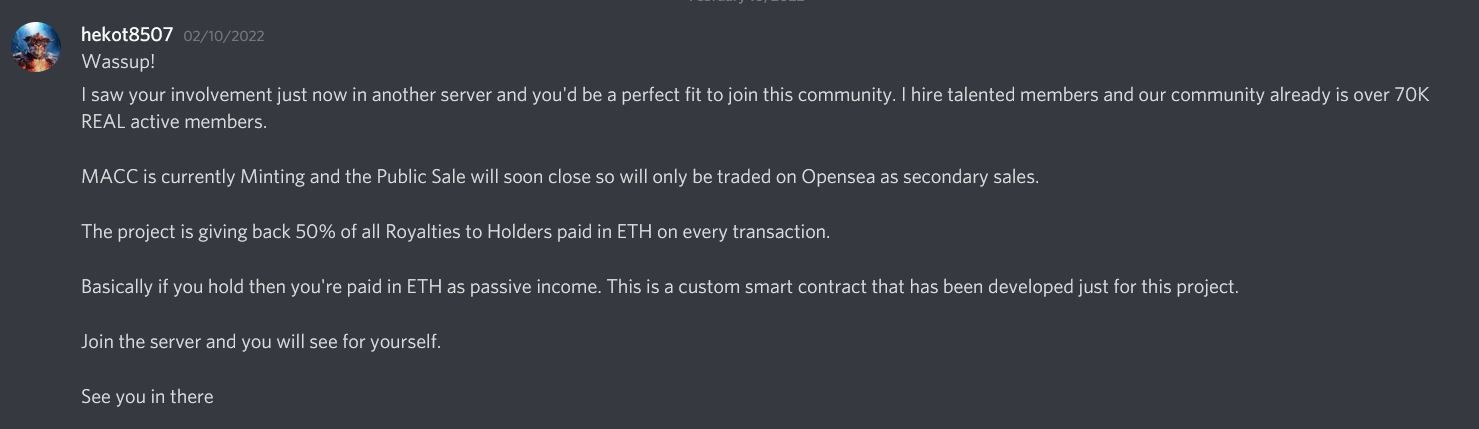

They DM You

NFT projects DMing me on Discord is instantly sus — while an unsuspecting NFT newbie might think they’re being proactive, what they’re really being is spammy. When I joined the MetaFriends Discord last week for my whitelisting article, I got two identical DMs from separate accounts about the same NFT project within minutes. Bots or not (though I’m guessing bots), it’s spam, not a legit pitch. These kinds of DMs immediately call into question the legitimacy of their following.

Low Engagement — from users and from founders

Does a project have a Twitter with a lot of followers and a Discord with thousands of members? If so, that might mean they have a legitimate following… or it can mean there’s a lot of bots and fake accounts filling the ranks to inflate the general interest. If there’s thousands of followers within just a few months or even weeks before the first mint, you’ve got to wonder if they all are legit. At least checking the Twitter and Discord are free, so to ensure that a project is worth your backing, poke around the Discord and see what’s going on — if anything’s going on at all.

Low engagement among followers/members can be a hard metric to measure against large projects, but engagement among the project founders is key. If the founders don’t engage with their community via AMAs, Twitter Spaces, etc., or they ban anyone who raises questions about the project or roadmap, that’s a huge red flag. Even if undoxxed, the founders should at least engage with the folks who want to buy into their project.

Overinflated Mint Price and/or Chaos on Mint Day

More and more NFT projects are offering higher mint prices, but it’s not always justified. In fact, unless it’s totally unique or launched by a team established in the NFT space, the mint price is probably way too high.

If you’re looking at what is apparently a brand-new or derivative NFT project with a floor price of 1ETH, you’ve got to ask yourself, is this really worth that? Pretty much every rugpull started out at an overinflated floor price before quickly dropping like a rock.

And while issues on mint day aren’t unheard of even for green-flag projects, bad projects are often beset with problems. This is made even worse when the team doesn’t communicate or decides to ban people who ask questions.

Bad Design

As an aesthete and design nerd, I find this one pretty easy to catch. Good web design is huge in this day and age, especially if we’re talking about projects that are based entirely on the internet (such as most NFT projects). If the website UI is wonky, or there’s blatant misspellings or bad grammar, or if it just doesn’t look good, those are huge signs that the team behind the project doesn’t really care about it. Good design, just like dressing up for important client meetings, is a way of showing that you care. We all like things that look good.

Tangentially, bad art is also a red flag — but why would you invest in something that’s creating bad art anyway? If you think that bad art is acceptable as long as you think it’s going to be worth more in the future, then I’m sorry, you deserve to be rugged.

Big Promises

Thanks to the success of BAYC, ape pfps are everywhere — but how many of them are actually claiming to be the next BAYC? Making a sweeping claim that a project is the Next Big Thing is a major red flag — because no one, least of all the founders, really know if it’s going to be or not. It’s great to express confidence in your project, but that kind of oversell stinks of rugging.

Low Owners:Token Ratio

A project with only a few dozen or hundred holders among thousands raises another big red flag. If a relative few own a majority of the NFTs, their power to drop their holdings for some quick cash, and therefore cause the price to crash, dramatically increases. And if the founders, or friends of founders, are among them, that makes an eventual rugpull even more likely.

Unverified on Etherscan

A smart contract verified through Etherscan grants at least an official guarantee that the code will work on Ethereum. Unverified contracts may not work, likely leading to minting mishaps, as mentioned above. Verified contracts handily have that blue checkmark beside the contract tab — so beware if there’s no checkmark, especially with large-scale NFT projects.

Check out the Mutant Age Camel Club contract (unverified) and compare it with the Geisha Tea House contract (verified) to see the difference.

Any one of these red flags on their own is pretty benign, but if you see three or more of these come up in an NFT project you’re interested in, run away fast and be glad you did your research and didn’t get in too deep.

However, no NFT project is guaranteed to succeed, even if all they’re waving is green flags. That’s the nature of such a crowded and competitive space. But once you’ve looked for all the red flags, at least you have a better idea of what you’re getting into. As always, do your own research, be smart, and stay safe out there!