UPDATE: Binance to Acquire FTX

Over the last 24 hours, as capital fled FTX, a massive short pushed the FTT token down over 30%. FTX was able to survive the onslaught by agreeing to a "strategic transaction" with Binance:

1) Hey all: I have a few announcements to make.

— SBF (@SBF_FTX) November 8, 2022

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

This means that Binance is acquiring FTX. In stark contrast to yesterday's jabs and criticisms (highlighted below), FTX CEO Sam Bankman-Fried praised Binance's Changpeng "CZ" Zhao for doing "an incredible job of building out the global crypto ecosystem." SBF then went on to say the move was "user-centric" and that all accounts and funds were safe.

For a detailed account of the feud and the market dynamics that led to this acquisition, read below...

Binance v. FTX: CZ Declares Ceasefire (originally posted Nov 7th 5pm PST)

After less than a week, the epic exchange battle between Binance and FTX, and the respective battle between their dueling CEOs, CZ and Sam Bankman-Fried (SBF), has ended. Calls for peace were initiated through CZ’s “back to building” tweet on Monday afternoon. In a sign of tacit acceptance of terms, FTX tweeted its own de-escalatory shitpost. But will there actually be “Peace in our time?”

— FTX (@FTX_Official) November 7, 2022

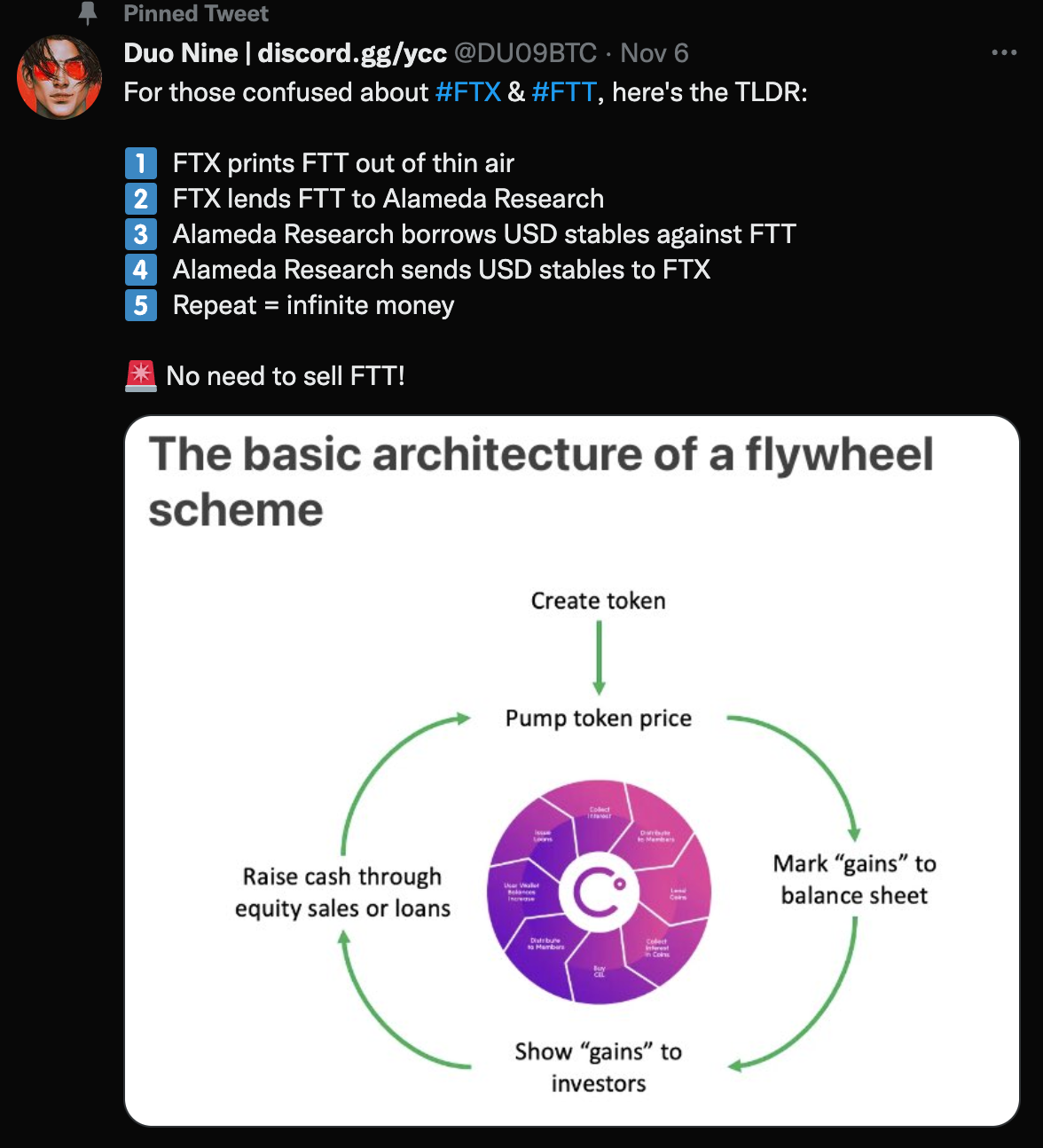

As a recap, it all started on November 2nd when CoinDesk posted a story about shady balance sheet manipulation between FTX and sister company Alameda Research. Essentially, FTX and Alameda had a flywheel scheme. FTX would send its native token, FTT, over to Alameda. Alameda would get a stablecoin loan backed against that FTT. Alameda would then send the stablecoins to FTX. This appears to create a positive feedback loop of infinite money… in reality, billionaire SBF was using his exchange and his trading company to inflate his assets.

In the wake of this Alameda revelation, CZ declared that Binance would liquidate its $2.1 billion of FTT tokens. He pledged to minimize market impact and dump the FTT over a few months. However, CZ made references to Luna when explaining the FTT sale as part of “lessons learned.” This added to public speculation that Alameda and/or FTX were insolvent. Market insanity insued.

Yes, this is part of it. https://t.co/TnMSqRTutr

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Shorts of FTT hit the market hard as retail traders tried to get in on the feeding frenzy. As a desperate battle was waged to inject capital into FTT, FTX’s executives went on a PR offensive. Ryan Salame, one of FTX’s Co-CEO’s, called CZ “literally the worst” while SBF tweeted that “A competitor is trying to go after us with false rumors.” While the situation calmed down on the PR front hours later, the damage from FTT shorts may continue to build up for FTX.

Analysis by Dylan LeClair shows a massive deployment of capital is being thrown into the FTT battle. Every dollar that FTX uses to defend its currency is being gobbled up very quickly. Only time will tell if FTX is able to hold the line.

Emerging market central bank dumping excess reserves to defend currency pic.twitter.com/Xh7Luv14K0

— Dylan LeClair 🟠 (@DylanLeClair_) November 7, 2022

If FTX survives, The Great Crypto Exchange War of 2022 will merely be a footnote in history. If FTX implodes, this will be the cherry on top of a massive reversal. Billionaire Sam Bankman-Fried was crypto's savior in June—he was even compared to J.P. Morgan during the Panic of 1907. Now SBF is a symbol of everything that’s wrong with the industry. The billionaire lost trust with several self-inflicted public blunders. By championing severe government regulation, and then awkwardly defending his stances, it seems likely that many people are rooting for FTX to fail. Judging by the shorts, people are voting with their money.