So this is a little awkward… The cryptocurrency lending / investment service and support platform BlockFi, whose mission is to ‘Redefine Banking’, recently ran a promo in which users / depositerd would receive a corresponding amount of the stable coin GUSD to utilize on the platform. The amount of stable coins received was intended to reflect each individual’s promotional reward earnings. Sounds simple enough.

Some clients who participated in the March trading promotion may see an inaccurate bonus payment displayed in their transaction history. Our team is working on a fix and the proper amounts will be reflected shortly.

— BlockFi (@BlockFi) May 15, 2021

‘Inaccurate bonus payment’ Hmm, ok. Doesn’t sound too serious..

In a statement sent to CoinDesk and also shared on Reddit, a BlockFi spokesperson said that on May 17, fewer than 100 clients were incorrectly credited with cryptocurrency associated with “a promotional payout that did not belong to them.”

— Zac Prince (@BlockFiZac) May 19, 2021

Oh. Ok.

No- we mistakenly credited a bunch of BTC in accounts but only sent a couple hundred BTC to <100 clients before it was caught. The amount at risk is a fraction of the BTC we own with equity capital and a fraction of loss reserves we carry for this exact purpose

— Zac Prince (@BlockFiZac) May 19, 2021

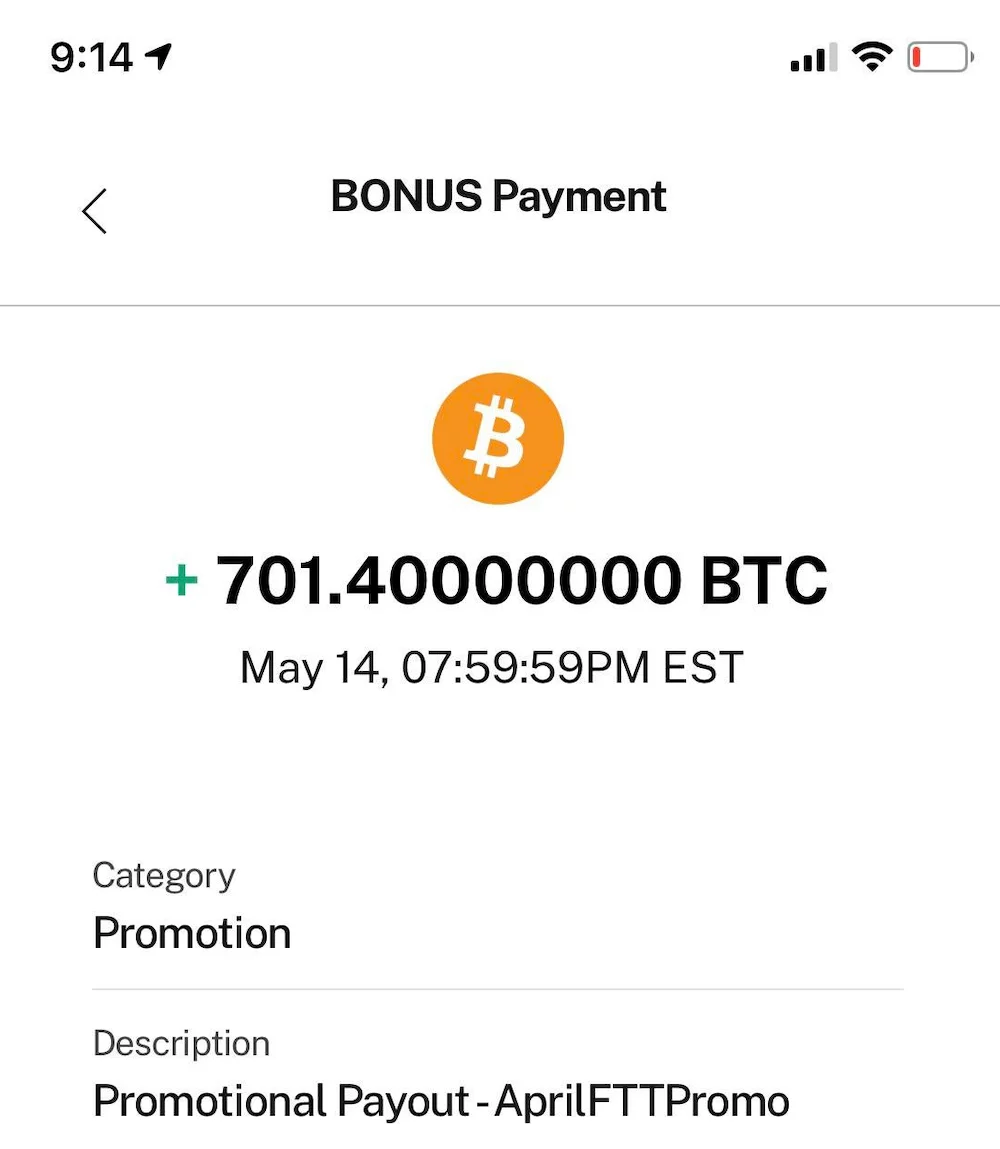

Really?! That’s pretty wild. Certainly not a great thing to find out about BlockFi if you are an active investor/participant on their custodial platform. Imagine signing into your BlockFi account to be surprised with this.

Of course the mistake transactions were to be reversed, which should be easily achieved within their centralized custodial service platform. Except, a handful of users who felt compelled enough actually were able to move their funds off of the platform before the reversal could be completed. Apparently there was more than enough time!

“(It was fewer than 100, the company said.) The firm’s exposure is around $10 million, though that amount is decreasing as more users return the coins, said Zac Prince, co-founder and chief executive officer of BlockFi.”“BlockFi carries loss reserves as part of its accounting policies and this is a fraction of existing loss reserves -- so no negative impact to equity or ongoing platform operations,” Prince wrote by email. “The issue that caused the withdrawals was fixed and incremental safeguards have been developed to prevent any similar issue in the future.”

News really began to spread once links to an /r Bitcoin post as well as multiple twitter users began to share their stunning screenshots. This playing out during a clear downtrend across the crypto market was not helpful!

The amateurs over at @BlockFi apparently paid some rewards in BTC instead of stablecoins, leading to rewards such as this one (+701 BTC). They now send threatening emails to their own customers or get sued. Financial advice based on our in-depth due diligence: never use @BlockFi. pic.twitter.com/aFYkQXzFY9

— The Financer (@TheFinancer) May 19, 2021

This is actually the first time I’ve taken a closer look at BlockFi. Good a time as any to see just what they are all about right?

‘BlockFi’s vision is to bridge the worlds of traditional finance and blockchain technology to bring financial empowerment to clients on a global scale.’

The nature of BlockFi’s business of course makes a mistake like this one a big red flag for current and future potential investors. It must feel pretty deflating to have what appears to be an incredible windfall taken away. Of course, this was a mistake which didn’t entitle these users to keep these ‘mistaken’ funds. Still, I expect many BlockFi users, affected or not, must think a little differently about the custodial service now. Anyone on the fence about utilizing their services must now take a serious pause and wonder ‘How could a mistake like this happen, and what else might be mismanaged by BlockFi?’