One big difference that we’ll see with the Ethereum 2.0 release is a move away from Proof-of-Work, a consensus mechanism that it uses alongside Bitcoin. On Ethereum 2.0, mining will be a thing of the past as the focus shifts to staking. The validation of transactions on this blockchain will no longer be contingent on computing power – and advocates believe that the upgrade will ultimately make Ethereum 2.0 far more secure. Another big bonus could be a sizeable improvement in energy efficiency, especially considering there are growing concerns about how much electricity is consumed by the BTC network.

Ethereum 2.0 is also expected to deliver a substantial boost to capacity, ultimately meaning that it can handle more transactions per second. With demand continually increasing, the emphasis on scalability will be a crucial step in ensuring the network is futureproof. This is achieved through shard chains, which allow transactions to be processed simultaneously instead of consecutively.

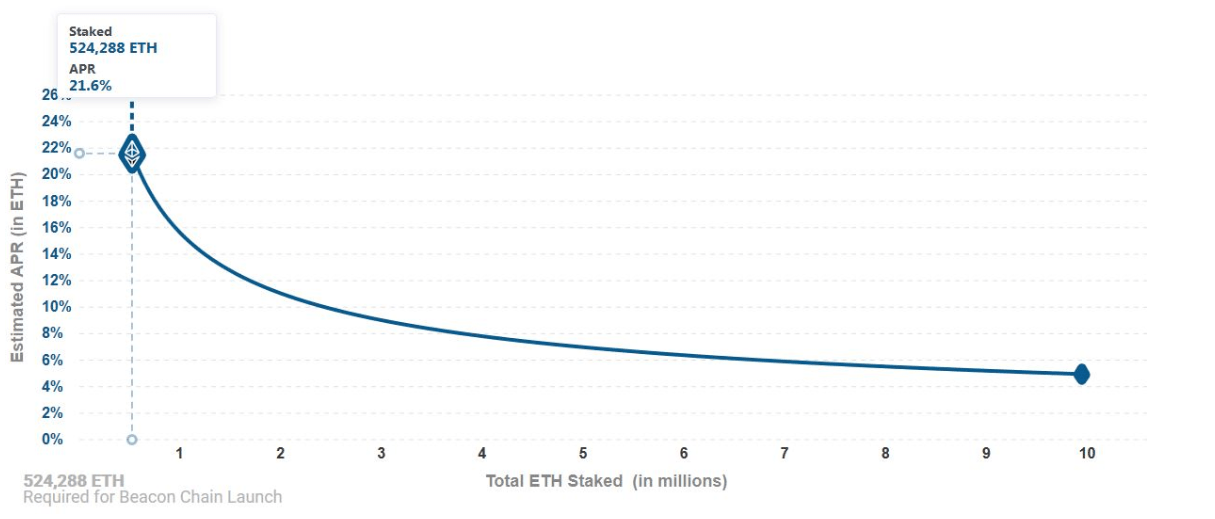

On a practical level, Ethereum stakers can now begin depositing the 32 ETH required to stake on Eth 2.0. Once 16,384 validators have deposited funds equivalent to a total of 524,288 ETH into the contract, the Beacon chain – the spine of Ethereum 2.0’s multiple blockchain design – will kick into action in what is called the “genesis” event of Ethereum 2.0. That event is expected within the next few weeks.

Stakers will begin earning inflation rewards after the genesis event by placing their ether as collateral on Eth 2.0. Staking rewards are reasonably high compared to other investments coming in between 8%–15% annually. And that’s for a good reason: Not only is there software risk, but the deposit contract to Eth 2.0 is a one-way bridge – at least for now.

As a sign of his confidence and commitment to the network, Ethereum co-founder Vitalik Buterin contributed 3200 ETH (~$1.3M) to the deposit contract. The contributed amount is enough to run 100 validators and it might have been chosen for symbolic reasons.

Ethereum 2.0 staking will provide an Annual Percentage Rate (APR) of 21.6%, at the minimum amount of 524,288 ETH required for launch. The returns are higher at first, because validators need to be incentivized to contribute the amount, which will keep falling as more validators join in.

The newly launched deposit contract address for Eth2 — the next-gen version of the Ethereum blockchain network — continues to grow, standing at 31,557 $ETH.

— Crypto₿uzz (@cryptobuzznews) November 5, 2020

3,200 #ETH of that — worth roughly $1.3M — was contributed by #Ethereum creator Vitalik Buterin, according to EtherScan.

While there are high rewards for staking ETH in the new iteration, there are penalties for not maintaining enough uptime to process activity and finalize blocks, acting in bad faith and contrary to the health of the network. This is done to ensure that participants act in good faith or lose rewards through minor penalties or the more serious slashing.

Any validator with 50% or 16 ETH of the 32 ETH slashed by the network for any reason is automatically ejected. It is advisable that users only stake if they have the required resources and technical knowledge or otherwise simply participate in a staking service.