Demand has skyrocketed. Exchange reserves fell 20% from 10M to 8M in the last few hours…"

Exchanges could be out of $ETH within 48 hours. Demand has sky rocketed. Exchange reserves fell 20% from 10M to 8M in the last few hours. With targets of $5k, $10k & $20k long term, I doubt many HODLers will sell their ETH in the $1-2k range. 🌐🖥️👽 #ETH2 #DeFi #NFTs #Gaming #DAO pic.twitter.com/rYPOch2u7p

— Alex Saunders 🇦🇺👨🔬 (@AlexSaundersAU) January 14, 2021

Well, I hate to be the one that says it, but 48 hours have passed, and exchanges still have ETH in their reserves.

This tweet gained a lot of backlash, especially from Glassnode's CTO, Rafael Schultze-Kraft, as he responded by saying, "Nothing unusual has happened; exchange flows are completely within their normal range."

Exchanges could be out of $ETH within 48 hours. Demand has sky rocketed. Exchange reserves fell 20% from 10M to 8M in the last few hours. With targets of $5k, $10k & $20k long term, I doubt many HODLers will sell their ETH in the $1-2k range. 🌐🖥️👽 #ETH2 #DeFi #NFTs #Gaming #DAO pic.twitter.com/rYPOch2u7p

— Alex Saunders 🇦🇺👨🔬 (@AlexSaundersAU) January 14, 2021

Although it is true liquidity in exchanges have dropped in recent months, it is nothing to the effect Saunders claims. The problem seemed to stem from CryptoQuant’s index as Saunders only used one index to conclude that exchanges would be out of ETH within 48 hours. I think this situation's whole moral is not to trust just one index but to look at multiple.

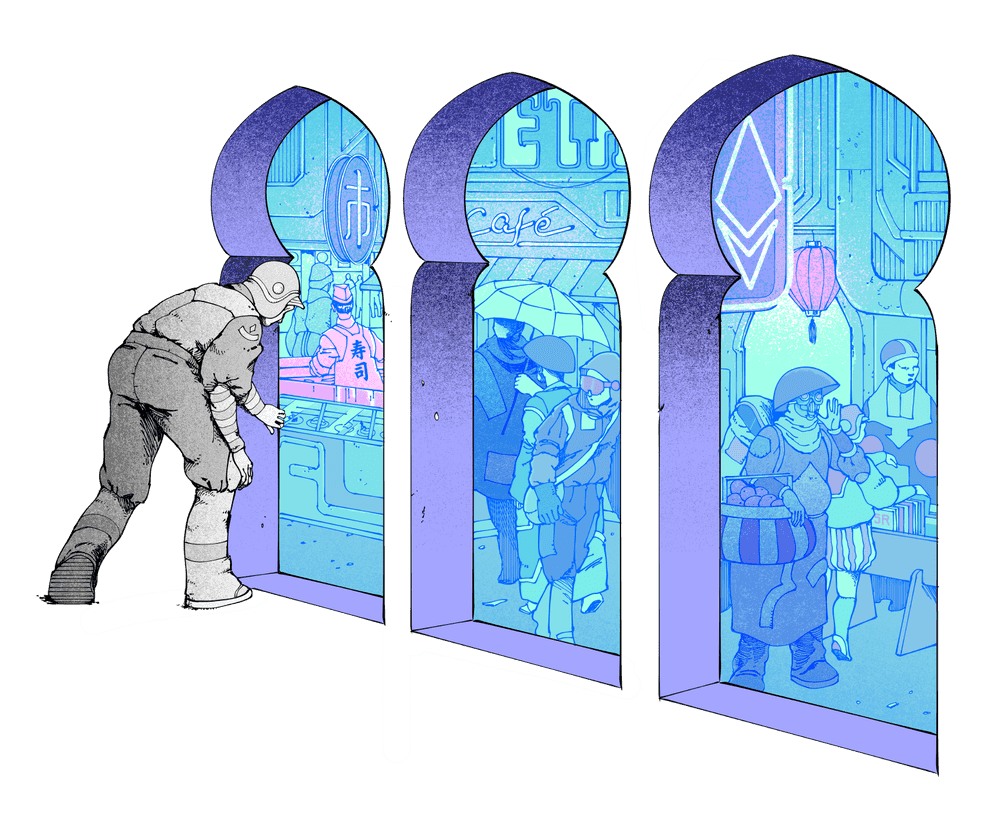

<center>Don’t be this guy.</center>