The so-called HEXicans filed the lawsuit on September 13 in Arizona. According to the lawsuit, the "Defendants [Coin Market Cap] have worked by various unlawful means to artificially suppress the value of HEX and artificially inflate the value of other cryptocurrencies."

Full details of formally file complaint as a matter of public record. Feel free to share your opinion but the court gets the final word. No opinions, ideas, or wishful thinking can stop it now. It's real and it's happening. #hex #hexflex https://t.co/ugNmekAaR9 pic.twitter.com/sLJTREHvyf

— Johnny Chaos (@ccfxstudios) September 15, 2021

This whole lawsuit is about the way Coin Market Cap ranks various coins. The HEXicans claim HEX is being unfairly ranked and therefore being suppressed. They claim by unfairly ranking HEX below its true rank in the ranking system; Coin Market Cap is keeping its profile and price unfairly low. They also claim that Coin Market Cap is doing this to benefit their parent company, Binance.

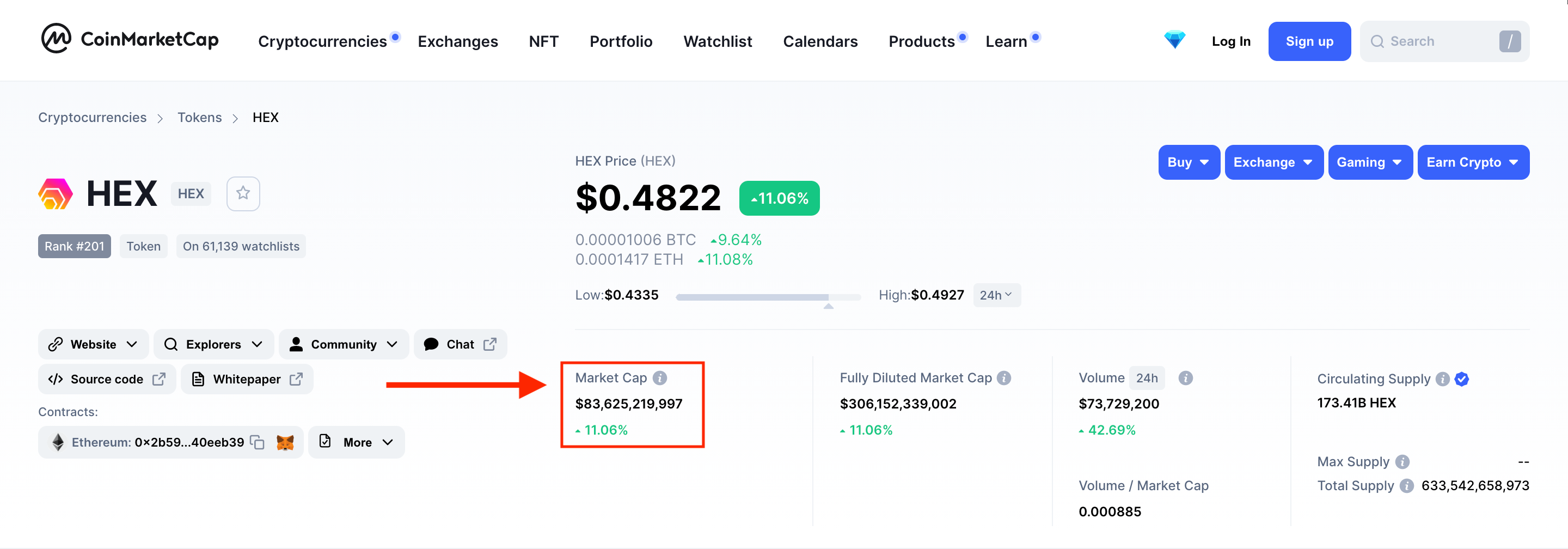

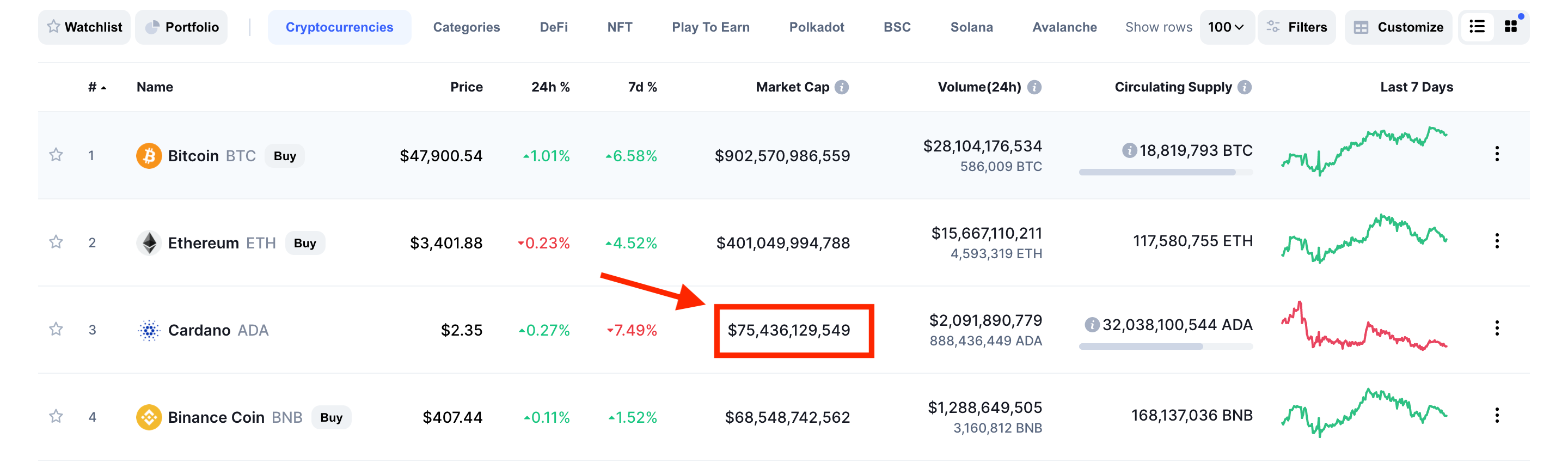

According to the plaintiffs, HEX is the best performing crypto asset of the year and has a Market Cap of $83 billion according to coin market cap, which is wrong. It's really around 266 billion. Despite this, Coin Market Cap has HEX locked at the #201 spot. According to Coin Market Cap's rankings, HEX should be in the #3 spot but is not.

This whole argument creates the debate of whether Coin Market Cap is unfairly suppressing the growth of HEX. The plaintiffs claim that Coin Market Cap is unfairly ranking HEX and is stopping people from seeing it and buying it.

"Upon information and belief, some other websites that allow users to buy cryptocurrencies also present them in the order they are found in CoinMarketCap.com's market cap rankings," the complaint says. "At the same time, smaller ranking websites including Nomics.com, CoinRanking.com, YahooCrypto, TradingviewCrypto, Coinpaprika.com, Etherscan.io, and CryptoCurrencyCap.com all had HEX ranked between fourth and tenth in size as of June 18, 2021."

The other half of the lawsuit alleges Coin Market Cap is suppressing HEX's rank to benefit Binance. The idea is that because Binance owns Coin Market Cap, it therefore "hides" coins from users at its own will to benefit Binance.

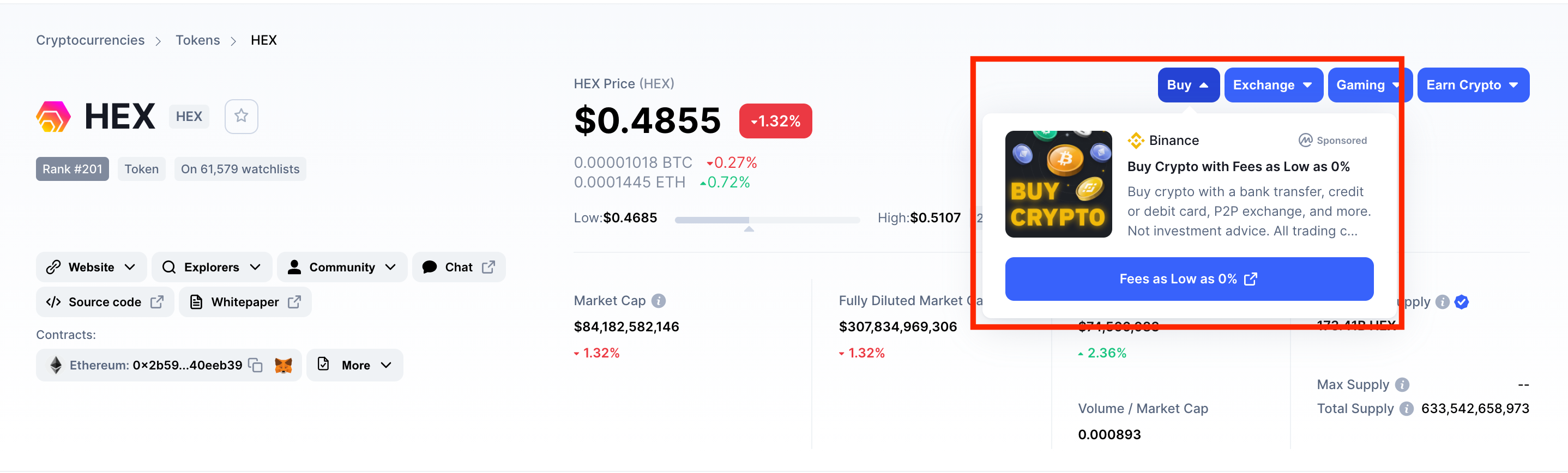

The suit also claims that the “buy” button next to all crypto coins in Coin Market Cap redirects users to either Blockchain.com or Binance's website without disclosing that they are being directed to a Binance company. Because Binance does not sell HEX, the suit claims Coin Market Cap does not see the need to promote HEX. "[d]espite CoinMarketCap.com's promises of objectivity and fairness, CoinMarketCap.com has a history of manipulating its rankings to the benefit of Binance."

The overall idea of this suit is that the plaintiff alleges Coin Market Caps' failure to rank HEX properly has had the effect of driving buyers away from HEX. Instead, they have pushed towards buying other coins that, unlike HEX, can be purchased through Blockchain.com or Binance and thus earn revenue for Binance.

The interesting part of this case is the precedent it will set in the largely unexplored DeFi space. Will this suit side with the hodlers or the company? Will there be more regulations after this lawsuit? Only time will tell...