In recent days, the world of decentralized finance (DeFi) was rocked by news of a substantial exploit targeting Curve Finance, one of the sector's most prominent decentralized exchanges. This incident, which reportedly drained over $52 million from Curve's Ethereum pools, sent ripples across the DeFi ecosystem.

A Code Bug Unleashes Chaos

At the heart of this incident is a sophisticated code bug within the base language of Curve's protocol. Vyper, the programming language used to write smart contracts on Ethereum, contained vulnerabilities in older versions that facilitated the exploit. This serves as a sobering reminder of the continual battle against code bugs in DeFi platforms.

PSA: Vyper versions 0.2.15, 0.2.16 and 0.3.0 are vulnerable to malfunctioning reentrancy locks. The investigation is ongoing but any project relying on these versions should immediately reach out to us.

— Vyper (@vyperlang) July 30, 2023

Despite extensive auditing and code scrutiny, latent vulnerabilities can persist, leading to devastating consequences when exploited. The situation underscores the critical importance of diligent code audits, constant updating of protocols, and the inherent risks that come with forking "battle-tested" platforms that may unknowingly carry these vulnerabilities.

A Reflexive Cycle of CRV Depreciation and Liquidation

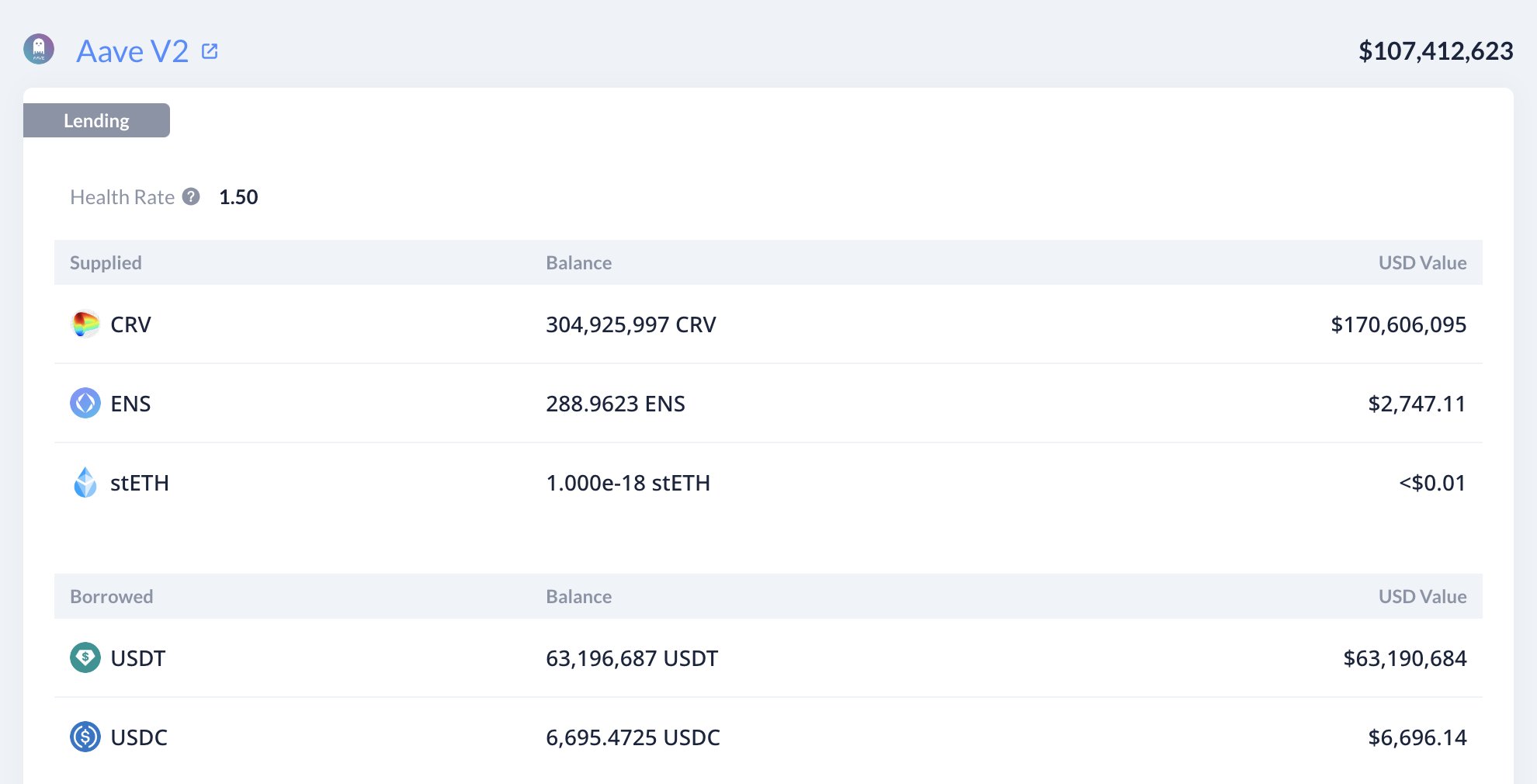

The impacts were most acutely felt by Curve's founder, Michael Egorov, who had utilized significant amounts of Curve's native token, CRV, as collateral for large loans across various DeFi platforms. In the aftermath of the exploit, we are left to dissect the implications of the hack and the potential cascading effects it could have on the broader DeFi landscape.

With the steep decline in CRV's value following the hack, a vicious feedback loop has been initiated. Egorov's substantial loans, collateralized by CRV tokens, are at risk of being liquidated. As people speculate on this imminent liquidation, the selling pressure on CRV intensifies, leading to further price depreciation. If Egorov's position gets liquidated, a domino effect of liquidations could follow across his other debt positions, likely creating considerable bad debt for the lending protocols involved.

Systemic Risk and Interconnectedness in DeFi

This incident provides a stark demonstration of the systemic risk inherent in the DeFi ecosystem. Many DeFi protocols are interconnected, and as seen with Curve, the liquidation of a large position such as Egorov's could potentially trigger a ripple effect across the industry. This cascade, especially in the presence of illiquid assets, could expose multiple protocols to bad debt and further destabilize the DeFi market. This scenario begs the question: What strategies and mechanisms should be implemented to mitigate the potential for such contagion?

DeFi's Wild West and its Future

While the decentralized nature of DeFi offers many opportunities, it also brings with it uncertainties that can have far-reaching consequences. For DeFi to mature and achieve broader adoption, systemic risk, code vulnerabilities, and over-leveraging must be addressed. As the dust settles from this exploit, DeFi platforms are left to learn valuable lessons about risk management and protocol resilience. How these lessons shape the future of DeFi remains to be seen.