Some of these DAOs set aside treasuries to fund future development of projects voted on by its members holding the corresponding governance token. Unfortunately, if someone were to have a majority stake, they would be able to do almost whatever they wanted.

The DeFi Education Fund

On June 29th, The DeFi Education Fund (DEF) was awarded 1 Million UNI to support a proposal “to fund a 501(c)(4) to defend the protocol and DeFi from legal and regulatory threats and help ensure the promise of DeFi.” The funds are accessible via a multi-sig wallet to the seven board members made up of Industry and DeFi corporate insiders.

- Larry Sukernik, co-founder, Reverie.

- Rebecca Rettig, General Counsel, Aave Companies.

- Jake Chervinsky, General Counsel, Compound Labs & Strategic Advisor, Variant Fund.

- Marc Boiron, General Counsel, dYdX Trading.

- Katie Biber, Chief Legal Officer of Brex, Board of Directors of Anchorage.

- Sheila Warren, World Economic Forum, Executive Committee (Cryptocurrency Lead).

- Marvin Ammori, Chief Legal Officer, Uniswap Labs.

The proposal laid out some vague goals along with a 4-5 year vesting period that was ultimately removed in the final vote. What seemed to be a positive phenomenon to the Uniswap and crypto community, may have become a watershed moment of what's to come for all governance token DAOs.

Upon receiving the funds, the DEF proceeded to dump 50% of their allocation on July 12th on the OTC market:

With the help of @GenesisTrading, we sold 500k UNI for ~$10.2M USDC in order to fund the efforts of the Defi Education Fund.

— Defi Education Fund (@fund_defi) July 12, 2021

In the next 24 hours, we will be sending 500k UNI to Genesis and receiving ~$10.2M USDC in return.

Following the news of the sell-off, it was noticed that one of the board members had sold $50k worth of UNI 3 hours before. It seems that this proposal passed through a coordinated effort of large UNI holder organizations lead by a16z, a tech Venture Capitalist (VC) firm Andreessen Horowitz(AH). This tweet shows coordination between some of the same UNI holders that voted on the DEF proposal, which was posted by Jeff Amico, one of the partners of Andreesen Horowitz

Thrilled to add @UMichBlockchain to our growing delegate network! 🚀@CalBlockchain @StanfordCrypto @HarvardLawBFI @PennBlockchain @BlockchainatCU @blockchainucla @MITBitcoinClub

— Jeff Amico (@jamico__) June 10, 2021

The future of crypto is bright 😎 https://t.co/6MBfx2wvWi

Institutions Are Coming

On July 22nd, the Block hosted a closed-door, half day institutional DeFi event with DeFi alliance & KPMG US, a multibillion-dollar tax auditing and consulting company. Multiple presenters along with members of the DEF, Jake Chervinsky and Marc Boiron, spoke during the limited event. Luckily, Chris Blec of Defi Watch was able to attend and provide public notes on the event. You can read the entire thread below.

Final chance to register for our half day institutional DeFi event with @defialliance & @KPMG_US

— The Block (@TheBlock__) July 21, 2021

Our speakers include:@StaniKulechov @JanvanEck3 @SergeyNazarov @hosseeb @santiagoroel @Melt_Dem @RuneKek @NoelleInMadrid @danrobinson @Mable_Jiang @TheChicagoVC pic.twitter.com/ebaHJCnhp9

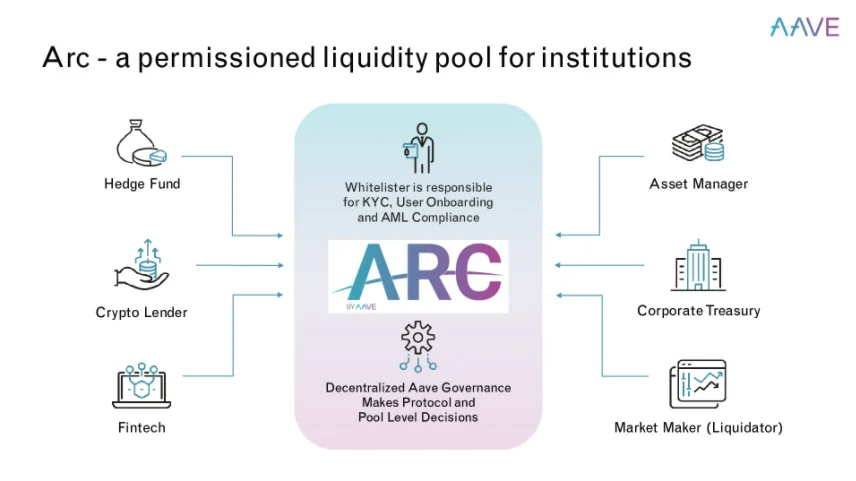

It seems the major issue holding institutions from moving into the DeFi space is regulation. Once regulators are able to get a stranglehold on users, VCs and Hedge Funds will finally have the opportunity to be involved in the DeFi space. AAVE is now building KYC infrastructure to allow for onboarding of institutions through ARC. Institutions will now be able to gather data on users eliminating privacy and sending us back to the status quo.

The biggest worry going forward is people don’t realize Decentralized Finance doesn’t mean Decentralized Control. VCs can seize control of DAOs by joining together without needing a majority of the circulating supply. The DEF proposal was passed using less than 15%. What does this mean to the future of DAOs controlled by governance tokens and DeFi overall?

Sushi Swap

A week after the DEF proposal passed, the Sushi Phantom Troupe “strategic raise” was introduced in the hopes of onboarding institutional investors. The proposal outlines offering 25% of Sushi’s treasury to sell funds to interested parties at a 30% discount. VCs have a large incentive to reach out to Sushi whales and organize quid pro quo agreements to get this proposal to pass, similar to what may have happened with the DEF proposal. Expected beneficiaries of the proposal are already seen dumping excess tokens expecting to be awarded this new lump sum

DeFiance & defimaximalist.eth already preparing themselves for the raise https://t.co/6t3FZVxsSz pic.twitter.com/HtWoh4rXg0

— PEPO🇦🇷 (@Luciano_vPEPO) July 15, 2021

It's becoming clear to see that DAOs with governance tokens and even blockchains with community funds and treasuries could come under attack by VCs.

Regulator Influence Begins

Uniswap’s front end, hosted by Uniswap Labs, delisted 129 tokens off their interface, announced in a tweet on July 23rd. They did this without any clear explanation and their website offered no help either. While the protocol still holds those delisted tokens and is accessible through other front ends, this slippery slope of “choosing winners” by censoring access is exactly why DeFi was created. This has dealt a blow to the credibility of Uniswap and is hopefully a wake-up call to the crypto community that regulators are coming and only together can we stop them.

As of today, we have started restricting access to a small number of tokens at https://t.co/liqYXtQoM2

— Uniswap Labs 🦄 (@Uniswap) July 23, 2021

These changes pertain to the interface at https://t.co/liqYXtQoM2 — the Protocol remains entirely autonomous, immutable, and permissionless.

Read more:https://t.co/60swtFXbsE

Are We Ready For What’s Next?

We live in an era where we have become apathetic and lost sight of the true values of DeFi. Billions of dollars worth of tokens are held on exchanges that could be used in nefarious ways at any point. Millions of dollars are lost in hacks or exploits every week because people send their crypto to unaudited projects that are inherently riddled with bugs to “yield farm” shitcoins and get rekt through impermanent loss. An entire blockchain bridge is controlled through an admin key, and don’t get me started on Tether. Have we forgotten our creed? “NOT YOUR KEYS, NOT YOUR CRYPTO. “ We finally have the attention of institutions, but are we really ready for what’s next?